Florida Tangible Personal Property Tax is a business tax levied on physical assets used in commercial operations, such as furniture, machinery, equipment, and leased property. It excludes real estate but covers nearly all tangible items that support business activity.

This tax exists to ensure local contributions from businesses based on the assets they own or lease. Any company operating in Florida—regardless of size or structure—must declare these assets annually to the county property appraiser using Form DR-405.

But navigating TPP obligations isn’t just a matter of compliance. It directly impacts tax liability, audit readiness, and financial accuracy. Failing to file or report assets properly can result in fines of up to 25%, along with legal and reputational risks.

Understanding how the tax is assessed, who must file, and how to claim Florida’s $25,000 exemption is essential for every business owner in the state. And with audits becoming more frequent, relying on outdated spreadsheets or incomplete inventories is no longer an option.

In this comprehensive guide, you’ll learn:

- What qualifies as tangible personal property in Florida

- Who must file Form DR-405 and by when

- How to calculate asset value and depreciation

- How to benefit from the $25,000 exemption

- What penalties apply for late, missing, or incorrect filings

- How to use asset management systems to ensure compliance

By the end, you’ll have a clear roadmap to meet Florida’s TPP requirements—accurately, efficiently, and strategically.

Table of Contents

ToggleWhat is Florida Tangible Personal Property Tax and why it matters

Florida Tangible Personal Property Tax is a local business tax charged on physical items used to run a company, such as equipment, tools, machines, and office furniture. It applies to any asset that has value, can be moved, and is not real estate.

This tax affects all kinds of businesses — from small service providers to large manufacturers — because most of them rely on tangible assets to operate. Whether it’s a restaurant stove, a dentist’s chair, or a warehouse forklift, all of these fall under the category of taxable property.

The purpose of this tax is to make sure that businesses contribute fairly to local services, based on the assets they use to generate income. Each year, companies must report the value of these items to the county property appraiser using Form DR-405, following a standard deadline.

The reporting process may sound simple, but it can be complex without a clear system to track what the business owns. Items depreciate over time, new assets are purchased, others are retired — and all of that must be reflected in your report.

Here’s a quick breakdown of what qualifies as tangible personal property (TPP) in Florida:

- Furniture and fixtures used in offices, stores, clinics, or warehouses

- Machinery and tools used in manufacturing or field operations

- Computers, printers, and technical devices for business use

- Leasehold improvements like shelving, lighting systems, or security setups

- Leased equipment, even if you don’t own it

- Signage, supplies, and other movable assets with business value

This tax is not applied to land, buildings, or intangible assets such as software licenses or brand value. The focus is only on the physical items your business can touch, move, and use in its daily operations.

Understanding what falls under this tax is the first step toward compliance. But more than that, it’s a way to keep your fixed asset records up to date, avoid unnecessary penalties, and manage your finances with greater accuracy.

Next, we’ll explain who exactly needs to file and what happens if you don’t.

Who must file and what types of property are subject to TPP tax in Florida

Any business that owns or uses tangible assets in Florida must file the Tangible Personal Property Tax return. This obligation applies regardless of the company’s size, legal structure, or industry.

If you own, lease, lend, or rent business assets as of January 1, you’re required to file Form DR-405 with the county property appraiser. This includes corporations, partnerships, LLCs, self-employed professionals, independent contractors, and even sole proprietors.

The rule also applies to lessors and lessees. If your business rents equipment to others or uses leased equipment, someone is responsible for reporting it. In some cases, both parties may need to file unless it’s clearly defined in the lease agreement.

This broad rule exists because tangible assets are considered tools that generate revenue. Whether you’re running a logistics company with hundreds of assets or a small design studio with five workstations, the tax is still applicable.

To determine if your business must file, ask yourself:

- Do you own or lease equipment used to deliver a service or product?

- Do you have physical inventory like shelving, POS systems, or signage?

- Do you operate from a location with furniture, tools, or improvements?

If the answer is yes, you fall under the reporting obligation. Even if your assets are minimal, Florida law requires you to file the first return to qualify for the exemption, which we’ll cover next.

Failing to file doesn’t just mean missing a form — it opens the door to penalties, audits, and interest charges. That’s why understanding what qualifies as tangible personal property is so important.

In the next section, we’ll show how Florida calculates the value of these assets and what you need to know about depreciation and fair market value.

How Florida assesses and values business property for tax purposes

In Florida, tangible personal property is assessed based on its fair market value as of January 1 of each year. This value represents the price a willing buyer would pay for the item in its current condition.

The county property appraiser uses standardized methods to estimate this value, combining several factors to determine how much tax you owe. These factors include the original purchase price, year of acquisition, depreciation, usage level, and asset condition.

For example, a computer purchased three years ago for $2,000 will have a lower taxable value today. The appraiser applies depreciation tables to estimate how much value the asset has lost over time.

This means two businesses with similar equipment may have different tax values depending on how old the assets are and how well they’ve been maintained. Proper documentation is essential to support your declared values.

Here’s what typically influences TPP valuation:

- Original cost of the asset, including delivery and installation

- Year the item was placed into service

- Type of asset (computer, vehicle, machinery, etc.)

- Current condition and estimated remaining useful life

- Depreciation based on industry-specific schedules

Florida does not use your internal accounting depreciation alone. Instead, they apply their own guidelines, often using a cost-based approach with standard tables set by the Florida Department of Revenue.

In practical terms, if your reported value is too low without explanation, the appraiser may adjust it upward. On the other hand, accurate reporting based on supporting documentation can prevent disputes and penalties.

A key takeaway: even fully depreciated assets in your books may still hold taxable value. That’s why tracking both accounting and physical depreciation is essential for compliance.

Next, we’ll explain how the $25,000 exemption works — and how your business can take advantage of it.

The $25,000 TPP tax exemption: eligibility and filing requirements

Florida offers a tangible personal property tax exemption for businesses with assessed assets valued at $25,000 or less. This exemption can reduce your tax liability to zero — but only if you follow the correct steps.

To qualify, you must file Form DR-405 and request the exemption on time. Once granted, if your asset value remains under the $25,000 limit in the following years, you may no longer need to file annually — unless the county appraiser instructs otherwise.

Even if your business owns just a few computers and office chairs, you’re required to file the first return to be eligible. Skipping the initial filing means you lose the exemption.

Who is eligible for the TPP tax exemption?

All business types operating in Florida may qualify for the exemption, including:

- Sole proprietors and freelancers

- Limited liability companies (LLCs) and partnerships

- Corporations and franchises

- Nonprofits engaged in commercial activity

- Home-based businesses using equipment for income generation

It doesn’t matter whether you own or lease the equipment. If the total assessed value of your tangible property is $25,000 or less, the exemption applies.

Which assets count toward the $25,000 limit?

The valuation considers all tangible items used in the business, such as:

- Office furniture, shelves, and display units

- Computers, printers, and related electronics

- Tools, machinery, and light equipment

- Point-of-sale (POS) systems and signage

- Leasehold improvements and business-owned supplies

Keep in mind that even assets acquired through financing or leasing are considered in the valuation. The exemption does not apply to real estate or intangible assets like software licenses.

Step-by-step: how to claim the exemption

To benefit from the exemption, you must take action. Here’s how the process works:

- Gather a list of all tangible assets used in your business: Include purchase dates, costs, descriptions, and condition of each item.

- Complete Form DR-405 accurately: You must declare all tangible property, even if the value is below $25,000.

- File by April 1 with your county property appraiser: Late filings may disqualify you from the exemption and result in penalties.

- Retain all supporting documents: If requested, you’ll need to prove the value and use of each asset listed.

What happens after you file?

Once you file and the exemption is approved:

- If your property stays below the threshold in future years, the county may waive your annual filing requirement.

- However, if your asset value increases or you expand operations, you must resume annual filing.

Some counties may send a notification each year confirming your status. If you receive one, follow the instructions even if you believe you’re still exempt.

Common mistakes to avoid

- Assuming you’re automatically exempt without filing the first return

- Underreporting asset value to qualify falsely for the exemption

- Forgetting to include leased equipment, which may still be taxable

- Ignoring county notifications that request updated filings

The $25,000 exemption is one of the most valuable tools for small businesses in Florida. But it only works if used properly, with full transparency and documentation

Florida TPP: What small businesses and sole proprietors need to know

Many small business owners in Florida don’t realize they’re subject to Tangible Personal Property Tax. Whether you’re a freelancer, a solo entrepreneur, or running a local shop, if you use equipment to generate income, you must report it.

The good news is that Florida offers exemptions and simplified rules — but only for those who follow the process correctly. This section provides practical guidance to help smaller operations stay compliant and avoid penalties.

Identify which assets count as tangible personal property

One of the most common mistakes is assuming that only large machinery or expensive equipment is taxable. In reality, most tools used for work can fall under TPP.

Examples of taxable items include:

- Computers, printers, and workstations

- Massage tables, salon chairs, or fitness equipment

- Cameras, sound gear, or musical instruments

- Shelving, filing cabinets, signage, and lighting

- Tools used in plumbing, construction, or repair services

If the item supports your business activity and has value, it’s likely taxable — even if you use it at home.

Take advantage of the $25,000 exemption

Florida offers a valuable exemption for the first $25,000 in assessed property value. For many small businesses, this means you won’t owe tax — but you must still file the initial return to activate the benefit.

Key reminders:

- File Form DR-405 on time, even if your assets are minimal

- Declare everything honestly to avoid rejection of the exemption

- If you qualify, you may not need to file again unless the appraiser requires it

Failing to file the first time is one of the main reasons small businesses lose this exemption.

Keep a basic asset log to stay organized

You don’t need expensive software to stay compliant — a simple spreadsheet is a good start. What matters is keeping your records updated and accessible.

Track at least:

- Item description and serial number (if available)

- Date of purchase and original cost

- Location of the asset (especially if you work from multiple places)

- Status (in use, stored, or no longer in service)

This log will be useful every year at tax time — and it will protect you in case of audit.

Plan ahead if you’re just starting your business

If you’re opening a new business in Florida, include TPP in your planning. The county will expect your first filing the year after you acquire your first asset.

Things to do:

- Create an asset list from day one

- Consult with your accountant or property appraiser before tax season

- Don’t assume you’re exempt just because you’re new — filing is still required

Being proactive avoids fines and sets your business up for smooth reporting year after year.

The consequences of ignoring Florida TPP

Failing to comply with Florida’s Tangible Personal Property Tax requirements can result in serious financial and legal consequences.

Understanding what’s at stake is essential for making compliance a priority.

Penalties and interest can escalate fast

When a business files late or fails to file at all, the county property appraiser applies financial penalties based on the total tax due. These charges are automatic and increase with each month of noncompliance.

Breakdown of consequences:

- Late filing: 5% added per month, up to 25% total

- Failure to file: 25% of the full tax value

- Underreported assets: 15% penalty on the unreported portion

- Interest: Applied monthly, especially if collection efforts begin

Even if your business qualifies for the exemption, missing the initial return disqualifies you from the benefit. In some cases, you may be charged as if the exemption never applied.

Your assets may be subject to legal enforcement

If the tax remains unpaid, counties can issue a warrant — a legal document authorizing collection actions. This includes placing a lien on your property, seizing equipment, or freezing business assets until the tax is resolved.

This process is public, meaning it may affect your credit rating, vendor relationships, or reputation in the community. It also increases legal costs and delays future operations or transactions.

Noncompliance can block asset or business sales

If you try to sell a business or its equipment and your TPP tax is unpaid, the transaction may be delayed or rejected. Buyers often request proof that all taxes — including TPP — are settled before closing a deal.

This is especially important when selling:

- Restaurants, clinics, or retail locations with fixtures and equipment

- Rental properties that include furniture and appliances

- Businesses transferring leasehold improvements or operational assets

Outstanding TPP taxes may force price reductions or renegotiations, and in some cases, buyers walk away entirely.

It’s not a one-time issue — it’s an ongoing obligation

Florida’s TPP is an annual requirement, not a single filing. Even if your asset list doesn’t change, you’re responsible for confirming your status every year unless notified otherwise.

Letting compliance slide one year can set off a pattern of neglect — increasing penalties and attention from tax authorities. Staying consistent with your filings keeps your business in good standing and reduces the risk of audit.

Filing deadlines, penalties, and compliance risks for Florida businesses

Florida Tangible Personal Property Tax follows a strict timeline. Missing deadlines or submitting incorrect information can result in significant penalties and increase your exposure to audits.

Businesses must file Form DR-405 every year by April 1, declaring the value of all tangible property owned or used as of January 1. This deadline applies even if you’re eligible for the $25,000 exemption — unless your county has notified you that no filing is required.

Key dates to remember

- January 1: Valuation date. All assets in possession on this day must be reported.

- April 1: Filing deadline for Form DR-405, sent to the county property appraiser.

- Post-April 1: Penalties begin to apply if the form was not filed.

No extensions are automatically granted. If you need more time, you must request an extension from the county property appraiser before the deadline.

Penalties for late or missing filings

Florida law applies strict financial penalties to encourage timely and accurate reporting. These penalties are based on the total amount of tax owed, even if you later qualify for the exemption.

- Late filing: 5% penalty per month (or part of a month), capped at 25%.

- Failure to file: Automatic 25% penalty on the total tax due.

- Underreporting or missing assets: 15% penalty on the unreported portion.

For example, if your business forgets to report certain leased equipment, the county can add those items to your assessment and apply the penalty.

Common compliance risks for businesses

Businesses often underestimate the complexity of TPP compliance. Here are some of the most common issues that lead to fines or disputes:

- Missing the deadline due to lack of reminders or calendar tracking

- Assuming leased items are the responsibility of the lessor, without verification

- Failing to update the asset list each year, especially after expansions or renovations

- Underestimating fair market value, resulting in tax reassessments

- Neglecting to request the $25,000 exemption properly

Each of these mistakes can result in unexpected costs — and in some cases, prompt an audit.

Best practices to stay compliant

To reduce risks and maintain full compliance, businesses should:

- Use a centralized system to track fixed assets, depreciation, and locations

- Review lease contracts to identify who is responsible for tax reporting

- Schedule annual reviews in January to prepare Form DR-405 in time

- Respond promptly to any requests or notices from the property appraiser

Being proactive avoids last-minute stress and demonstrates transparency to local authorities.

In the next section, we’ll show how a structured asset management system can simplify this process and make compliance easier than ever.

How asset management systems support TPP tax compliance

Managing Florida Tangible Personal Property Tax becomes significantly easier with the right tools. A fixed asset management system helps you track, document, and report your business assets with speed and accuracy.

Without a structured system, businesses often rely on scattered spreadsheets or outdated records — increasing the chances of underreporting or missing deadlines. With an asset platform in place, you gain control, visibility, and peace of mind during the entire tax cycle.

What an asset management system does for your business

An intelligent platform goes far beyond listing items. It automates critical steps in the TPP reporting process.

- Tracks each asset by type, location, and status

- Records purchase dates, costs, depreciation, and remaining useful life

- Flags items added or removed during the year

- Generates reports aligned with Florida’s appraisal standards

- Maintains a clean audit trail, ready for review at any time

You no longer need to guess the value of your equipment or scramble to gather documents. Everything is centralized and updated in real time.

Benefits of using technology for tax compliance

Whether your business owns 50 assets or 5,000, a digital system ensures accuracy and compliance. Here’s what you gain:

1. Time savings

Manual data entry is slow and error-prone. An automated system speeds up reporting and reduces administrative work.

2. Audit readiness

You can generate audit-ready reports with full traceability of assets, saving time in case of an inspection.

3. Depreciation tracking

Smart tools apply correct depreciation models and help justify your valuations to the county appraiser.

4. Exemption control

By tracking asset value throughout the year, you know when you’re near the $25,000 exemption threshold — and can act accordingly.

5. Compliance confidence

Automated alerts help you meet the April 1 deadline, preventing penalties and last-minute issues.

Signs your business needs an asset system

If you answer “yes” to any of the following questions, it’s time to consider adopting one:

- Do you have assets in multiple locations?

- Are you unsure of your total assessed property value?

- Have you missed tax deadlines in previous years?

- Do you rely on manual tracking or disconnected files?

Businesses that invest in fixed asset management gain more than tax compliance. They also improve inventory accuracy, financial planning, and operational control.

CPCON solutions for Florida TPP compliance

CPCON helps your business stay compliant, reduce tax risk, and gain full control over tangible assets.

What we deliver:

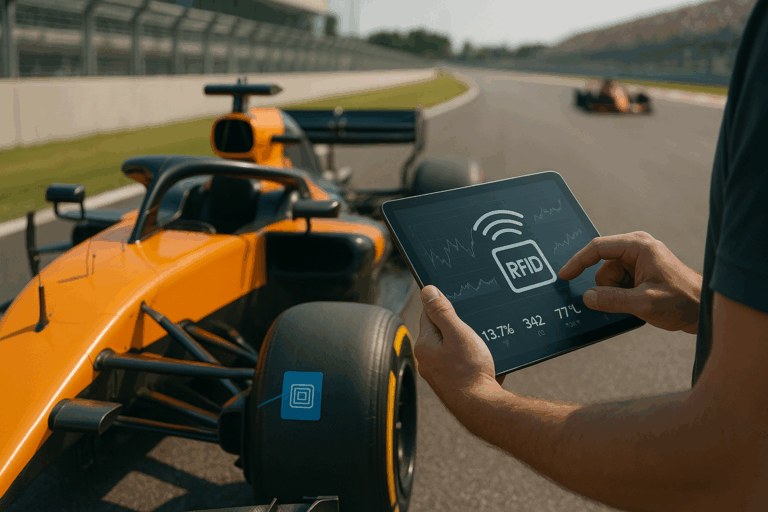

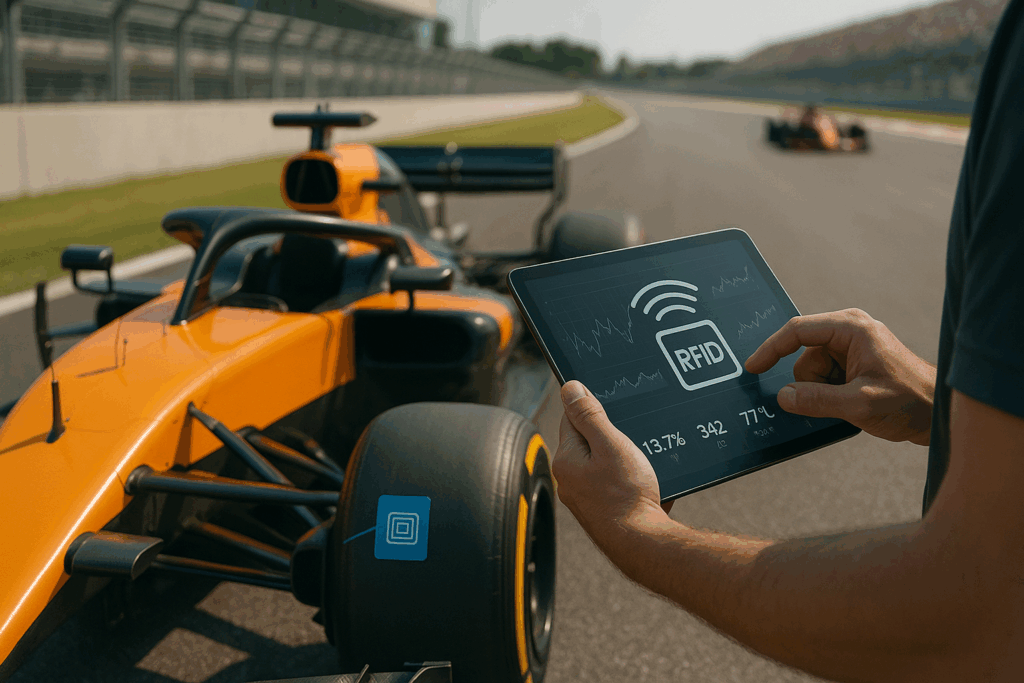

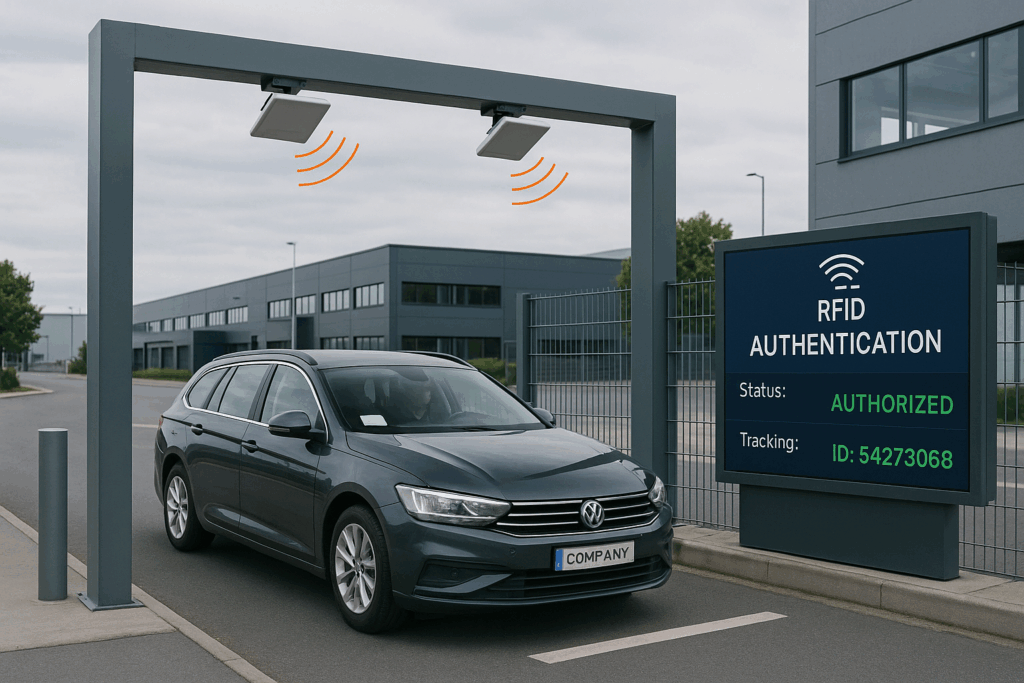

- Precise fixed asset tracking with RFID and automated reconciliation

- Audit-ready reports aligned with Florida TPP requirements

- Expert advisory to ensure accurate filing and avoid penalties

- $25,000 exemption guidance based on asset thresholds

- Seamless ERP integration for SAP, Oracle, and Totvs environments

Whether you manage 500 or 50,000 assets, we bring structure, accuracy, and speed to your compliance process.

Control your assets. Secure your tax strategy.

Ready to simplify your TPP compliance?

Talk to CPCON today and discover how our asset management solutions can help you file accurately, reduce tax exposure, and stay ahead of audits.

Why TPP tax compliance is more than just a filing task

Florida’s Tangible Personal Property Tax is not a one-time burden — it’s a recurring responsibility that affects every business with physical assets. From laptops in a home office to machinery in a warehouse, every item counts when it comes to transparency and financial control.

More than avoiding penalties, staying compliant helps your business maintain accurate records, improve asset management, and plan with confidence. When done right, TPP reporting becomes a valuable tool — not just for taxes, but for strategic decision-making across your operations.

Whether you’re managing a growing small business or a large enterprise with multiple sites, using the right systems and processes makes all the difference. From filing Form DR-405 to applying for the $25,000 exemption and avoiding legal risks, every step matters.

And you don’t have to face it alone.

Want to go deeper into asset control, RFID technology, or compliance best practices?

Check out our latest guides and discover how to turn operational challenges into competitive advantages.

TPP tax timeline: Key dates and what to expect each year

Florida Tangible Personal Property Tax follows an annual cycle, with clear deadlines and responsibilities. Missing these dates can lead to penalties — but knowing what happens in each phase helps you stay in control.

Below is a month-by-month breakdown of what business owners should expect and prepare for:

January: Know what you own

- January 1 is the valuation date: all tangible property in use or owned on this day must be reported.

- Review and update your fixed asset list to reflect the current status of your equipment, tools, and inventory.

February: Get organized

- Gather supporting documents: purchase dates, original costs, and descriptions.

- If you have leased assets, confirm with the leasing company who is responsible for reporting.

- Check if your county offers online filing for Form DR-405 and register if needed.

March: Final prep before the deadline

- Complete your internal asset reconciliation.

- Review the $25,000 exemption eligibility one more time — don’t assume you’re exempt unless confirmed.

- Contact your accountant or property appraiser if you have doubts or need an extension.

April: The official filing month

- April 1 is the filing deadline for Form DR-405.

- If you miss this date, penalties begin to apply immediately.

- If an extension was granted, be sure to meet the new deadline.

May to July: Appraisal and notification period

- The county property appraiser reviews filings and may request clarification or corrections.

- You may receive a Notice of Proposed Property Taxes — review it carefully for discrepancies.

August to November: Possible adjustments

- If you disagree with the assessment, you may file a petition with the Value Adjustment Board (VAB).

- Deadlines for appeal vary by county — act quickly if needed.

December: Plan ahead for next year

- Close your year-end asset tracking.

- Remove retired assets and record new acquisitions.

- Set calendar reminders for the next filing season.

FAQ

What is considered tangible personal property for tax purposes in Florida?

Tangible personal property (TPP) includes all physical items used in a business that are not part of real estate. Examples include furniture, computers, tools, signage, shelving, and leased equipment.

Do small businesses and freelancers have to file Florida’s TPP tax return?

Yes. Any business operating in Florida — including sole proprietors and home-based businesses — must file Form DR-405 if they own or use taxable assets. Filing is required to qualify for the $25,000 exemption.

What happens if I miss the TPP filing deadline?

If you file late or fail to file, penalties range from 5% to 25% of the tax due. The county may also apply interest, issue warrants, or enforce liens on business assets.

How is asset value determined for Florida’s TPP tax?

Value is based on the asset’s original cost, year of acquisition, depreciation, and condition. Counties use standardized appraisal guidelines to estimate fair market value as of January 1 each year.

How can CPCON help with TPP tax compliance?

CPCON provides end-to-end asset management solutions, including RFID tracking, automated reporting, inventory reconciliation, and expert support for TPP filing, helping you stay compliant and audit-ready.

Florida Tangible Personal Property Tax is an annual obligation that applies to business-owned physical assets like equipment, furniture, and tools. All companies — from freelancers to large corporations — must file Form DR-405 by April 1. Florida offers a $25,000 exemption, but only to those who file on time. Penalties for noncompliance include fines, interest, and potential legal actions. Businesses can stay compliant and avoid risks by keeping updated records, understanding key deadlines, and using an asset management system.

Discover CPCON Group: Global expertise in asset control and inventory solutions

CPCON Group is a global leader in asset management, fixed asset control, and RFID technology — trusted by companies like Nestlé, Pfizer, Scania, BASF, Coca-Cola Andina, Vale, Vivo, Petrobras, and Caixa.

With over 25 years of experience, we support complex operations across industries by delivering precision, innovation, and total visibility over assets. Our offices span North America, Latin America, Europe, the Middle East, and the Caribbean, including cities like New York, São Paulo, Lisbon, London, Dubai, and Grand Cayman.

Want to explore our global presence? We’re active in:

- North America: Toronto, New York, Miami, Minneapolis, Seattle, Dallas

- Latin America: São Paulo, Buenos Aires, Lima, Bogota, Mexico City

- Europe: Lisbon, Porto, London, Birmingham, Milan, Rome, Turin, Madrid, Bilbao

- Middle East: Dubai, Saudi Arabia

- Caribbean: Tortola, Grand Cayman

Follow our LinkedIn Showcase Page to dive deeper into our insights, trends, and global solutions for asset control, inventory management, and RFID innovation.