What is a fixed asset and why is it so important for companies in industries such as manufacturing, healthcare, logistics, retail, and energy? A fixed asset is any durable, tangible, or intangible resource used in business operations that is not intended for resale. Managing fixed assets effectively is crucial to ensure accounting accuracy, safeguard company property, and maintain tax compliance.

More than a bookkeeping requirement, fixed asset management has become a strategic decision. From accurate depreciation to preventing losses and ensuring audit readiness, companies that master this process gain visibility, predictability, and competitive advantage. This is where CPCON, a global leader in asset management, combines technology, automation, and consulting expertise to transform fixed assets into real business value.

In this article, you will learn:

- What is considered a fixed asset;

- The difference between tangible and intangible assets;

- How to classify and account for fixed assets correctly;

- Why fixed asset management is strategic;

- And how CPCON supports companies worldwide in this journey.

Table of Contents

ToggleWhat is a fixed asset?

A fixed asset is a long-term resource that a company uses to run its daily operations. It is not acquired for resale, but to support production, service delivery, and overall business performance. In accounting, fixed assets are part of the non-current assets, recorded on the balance sheet and gradually expensed through depreciation or amortization.

Key characteristics

- Used in operations, not intended for immediate sale

- Provides benefits for more than one year

- Capitalized according to company policy and accounting rules

- Subject to depreciation (tangible) or amortization (intangible) over time

What a fixed asset is not

- Inventory or raw materials, which are meant to be sold or consumed quickly

- Low-value items that fall below the company’s capitalization threshold and can be expensed immediately

Common examples

- Buildings and improvements

- Machinery and industrial equipment

- Vehicles and logistics equipment

- IT hardware such as servers and networking devices

- Intangible assets such as software licenses, patents, or trademarks

Why the definition matters

Getting this definition right is more than an accounting formality. A proper classification avoids tax errors, supports audits, and ensures that managers see the real value of their business infrastructure. For multinational companies, this clarity is also key to aligning local practices with international standards like IFRS and US GAAP.

Fixed asset examples across key industries

Fixed assets look different depending on the industry, but their role is always the same: enabling operations and generating long-term value. Understanding these examples helps companies design better control policies and avoid misclassification.

Manufacturing and heavy industry

- Production machinery: lathes, presses, conveyor belts

- Industrial plants and facilities: factories, warehouses

- Specialized tools: precision equipment used in production lines

Healthcare

- Medical equipment: MRI scanners, ventilators, surgical robots

- Hospital infrastructure: clinics, labs, patient care facilities

- Technology assets: diagnostic software, medical databases

Logistics and transportation

- Vehicles: trucks, vans, forklifts

- Distribution infrastructure: cross-docking hubs, conveyor systems

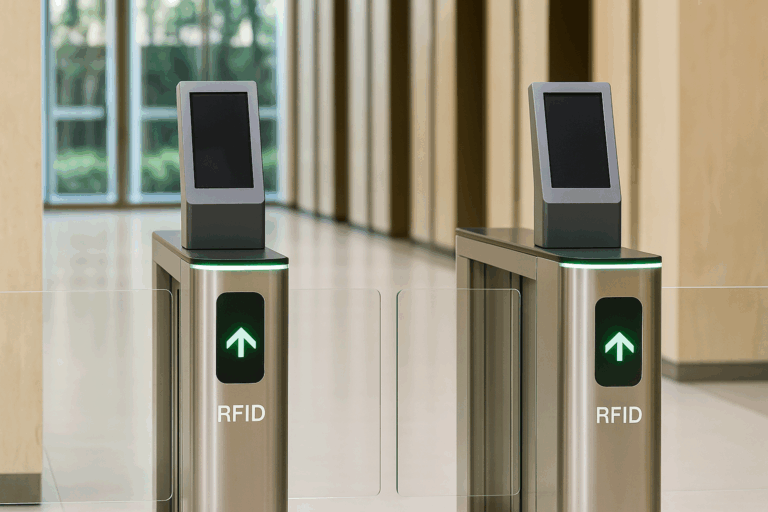

- RFID and IoT devices: essential for real-time tracking

Retail

- Store equipment: shelves, point-of-sale systems, kiosks

- Warehousing assets: automated storage and retrieval systems

- Technology: servers and retail management software

Energy and utilities

- Power plants and turbines

- Transmission lines and substations

- Specialized vehicles and field equipment

Tangible vs. intangible assets: the essential distinction

Not all fixed assets can be touched. Some are physical resources, while others represent rights or long-term value. Knowing how to distinguish between tangible and intangible assets is critical for accurate accounting and compliance.

Tangible fixed assets

- Definition: Physical assets with measurable form and substance.

- Examples: buildings, machinery, vehicles, IT hardware, office furniture.

- Accounting treatment: depreciated over their useful life to reflect wear, usage, and obsolescence.

Intangible fixed assets

- Definition: Non-physical assets that still generate long-term value for the business.

- Examples: trademarks, patents, software licenses, customer databases, franchise rights.

- Accounting treatment: amortized over the useful life, except for those with indefinite life (such as goodwill), which are tested annually for impairment.

Why this distinction matters

- Compliance: Misclassifying assets can distort financial statements and raise red flags in audits.

- Valuation: Tangible assets typically support financing and collateral, while intangibles often drive competitive advantage.

- Strategic decisions: Companies that properly identify and track both categories gain visibility on where value is truly created — in infrastructure, technology, or intellectual property.

Bottom line: separating tangible from intangible assets is more than a technical step. It ensures transparency for stakeholders, strengthens governance, and reveals the real drivers of business performance.

How to classify and account for fixed assets correctly

Classifying and recording a fixed asset is the starting point for solid financial reporting. Mistakes at this stage can affect taxes, audits, and even investment decisions.

Key criteria for classification

- Purpose of use: must support operations, not be acquired for resale.

- Useful life: greater than 12 months.

- Materiality: above the capitalization threshold defined by company policy.

- Nature: can be tangible (physical) or intangible (non-physical).

Accounting treatment

- Initial recognition: recorded at acquisition cost, including all necessary expenses to put the asset in use (shipping, installation, non-recoverable taxes).

- Depreciation (tangible): systematic allocation of cost over useful life.

- Amortization (intangible): gradual expense recognition for finite-lived intangibles.

- Impairment: reduction when the asset’s carrying amount exceeds its recoverable value.

- Disposal or sale: removal from books when the asset is sold, scrapped, or no longer in use.

Common mistakes to avoid

- Recording consumables or spare parts as fixed assets.

- Capitalizing low-value items below the threshold.

- Failing to update records after relocations, disposals, or technical upgrades.

Why accuracy matters

Precise classification ensures that:

- Balance sheets reflect true business value.

- Tax calculations and depreciation schedules are correct.

- Auditors and stakeholders trust the company’s financial information.

In practice: Proper classification is not just about compliance. It gives leaders visibility on the full lifecycle of assets, supporting smarter investments and long-term planning.

Why fixed asset management is a strategic decision

Managing fixed assets goes far beyond accounting compliance. It is a corporate strategy that directly impacts efficiency, risk management, and long-term growth.

Strategic benefits

- Operational visibility: knowing exactly where assets are, who is responsible, and their current condition.

- Financial accuracy: depreciation and amortization aligned with reality ensure tax compliance and trustworthy financial statements.

- Cost optimization: avoiding duplicate purchases, extending useful life through preventive maintenance, and reducing capital expenditures.

- Risk mitigation: preventing fraud, theft, and regulatory issues through accurate records and technology-enabled monitoring.

- Decision-making power: asset intelligence supports investments, divestments, and resource allocation with precision.

Real-world impact

- A manufacturer with outdated machines on the books risks poor planning and unplanned downtime.

- A hospital without clear visibility of medical equipment may face compliance issues and operational bottlenecks.

- A retail chain that doesn’t track store assets correctly risks overspending and reducing profitability.

The leadership perspective

For executives, fixed asset management is not just a support function — it is a lever of competitiveness. Companies that manage their assets with accuracy and innovation create resilience, anticipate risks, and unlock hidden value across the organization.

How technology transforms fixed asset control

Traditional spreadsheets and manual inventories are no longer enough to manage thousands of assets spread across plants, offices, or warehouses. Technology has become the turning point that separates companies with basic control from those with full visibility and strategic intelligence.

RFID and real-time tracking

- Precision: each asset receives a unique identifier, eliminating “ghost assets.”

- Speed: inventories that once took weeks can be completed in hours.

- Visibility: managers know in real time the location, status, and movement of assets.

Integrated asset management software

- Automation: depreciation, amortization, and impairment tests calculated automatically.

- Integration: compatibility with ERP systems such as SAP, Oracle, or TOTVS.

- Analytics: dashboards with lifecycle insights, replacement forecasts, and cost optimization scenarios.

IoT and automation

- Sensors: monitor usage, temperature, and performance of critical equipment.

- Predictive maintenance: anticipate failures and extend useful life.

- Compliance support: real-time data facilitates audits and regulatory inspections.

Strategic outcome

By combining RFID, software, and automation, companies move from reactive asset management to proactive control. This shift transforms fixed assets into a source of competitive advantage, ensuring efficiency, transparency, and resilience in global operations.

Choosing the right fixed asset management software

Selecting the right system is one of the most important decisions in building a professional asset management process. The right tool not only automates accounting tasks but also delivers real business intelligence.

Step 1 – Identify business needs

- Map the types of assets your company owns.

- Define operational goals: mobility, ERP integration, RFID tracking, or compliance support.

Step 2 – Check system compatibility

- Ensure seamless integration with existing ERPs (SAP, Oracle, TOTVS, etc.).

- Confirm the ability to handle multiple sites, currencies, and reporting standards.

Step 3 – Focus on user experience

- A functional, intuitive platform reduces resistance from teams.

- Training time and adoption rate are critical for success.

Step 4 – Involve stakeholders

- Engage finance, operations, IT, and compliance teams in the evaluation.

- Guarantee the system addresses both technical and strategic requirements.

Step 5 – Test with real data

- Run demos and pilot tests using actual asset data.

- Assess reporting, speed, and accuracy under real operating conditions.

Step 6 – Evaluate support and implementation

- Choose a partner that provides specialized training and continuous technical support.

- Ensure there is a clear roadmap for implementation and post-go-live follow-up.

The strategic view

The right software is not just a cost — it is an investment that strengthens governance, accelerates audits, and reveals hidden savings across the asset lifecycle.

CPCON solutions for global fixed asset management

For more than 25 years, CPCON has been transforming the way companies control and value their fixed assets. With operations across the Americas and a client base of over 2,000 organizations, CPCON combines technology, methodology, and expertise to deliver precision and innovation.

Our key solutions

- RFID-enabled physical inventory – real-time tracking with unmatched accuracy and speed.

- Physical-to-financial reconciliation – alignment between records and reality, reducing audit risks.

- Asset cleansing and restructuring – elimination of ghost assets and creation of a reliable baseline.

- Valuation and revaluation – determination of fair market value for compliance, M&A, and financing.

- Integrated asset management software – complete lifecycle control, automated depreciation, and strategic dashboards.

- Specialized consulting – technical expertise adapted to each industry, from healthcare to logistics and energy.

Ready to turn fixed assets into real business value?

With CPCON, your company gains control, compliance, and efficiency through technology and expertise.

Conclusion

Fixed assets are more than line items on a balance sheet. They are the backbone of operations, the foundation of long-term growth, and a key driver of business competitiveness. Companies that manage their assets strategically gain visibility, reduce risks, and unlock efficiency across the entire organization.

FAQ

1. What is a fixed asset in business?

A fixed asset is a long-term resource, tangible or intangible, used in operations for more than a year and not intended for resale. Examples include buildings, machinery, vehicles, and software licenses.

2. How are fixed assets different from current assets?

Current assets can be converted into cash within 12 months, such as inventory and accounts receivable. Fixed assets are held for long-term use, supporting operations instead of being sold quickly.

3. Why is fixed asset management important?

Because it ensures financial accuracy, tax compliance, risk reduction, and operational efficiency. Poor management can lead to ghost assets, tax errors, and unnecessary costs.

4. What are common mistakes when classifying fixed assets?

Confusing inventory or consumables with fixed assets, capitalizing low-value items below the company’s threshold, or failing to update records after disposals or relocations.

5. How can technology improve fixed asset control?

Through RFID tracking, automated depreciation, and integrated software. These tools provide real-time visibility, speed up inventories, and support smarter decisions.

Get to Know CPCON Group: A global expert in asset management and inventory solutions

CPCON Group is a global leader in asset management, fixed asset control, and RFID technology. With over 25 years of experience, we have supported major companies such as Nestlé, Pfizer, Scania, BASF, Coca-Cola Andina, Vale, Vivo, Petrobras, and Caixa in high-complexity projects.

Curious about our global footprint? We are present in:

- North America: Toronto, New York, Miami, Minneapolis, Seattle, Dallas

- Latin America: São Paulo, Buenos Aires, Lima, Bogotá, Mexico City

- Europe: Lisbon, Porto, London, Birmingham, Milan, Rome, Turin, Madrid, Bilbao

- Middle East: Dubai, Saudi Arabi

- Caribbean: Tortola, Grand Cayman

Follow our LinkedIn Showcase Page and stay updated with strategic content on asset control, inventory management, and RFID innovation across industries.

A fixed asset is a long-term resource, tangible or intangible, used in business operations for more than one year and not intended for resale. Examples include buildings, machinery, vehicles, and software licenses.