Taxes on tangible personal property assets – also known as “fixed assets” – represent a significant portion of a business’s state and local tax obligation. One of the challenges in managing property tax is properly identifying and reporting all the assets that are subject to tax, as well as properly allocating the correct depreciation schedule. Inferior asset accounting records that contain ghost assets, grouped assets, and other data gaps, expose a business to risk in tax overpayments.

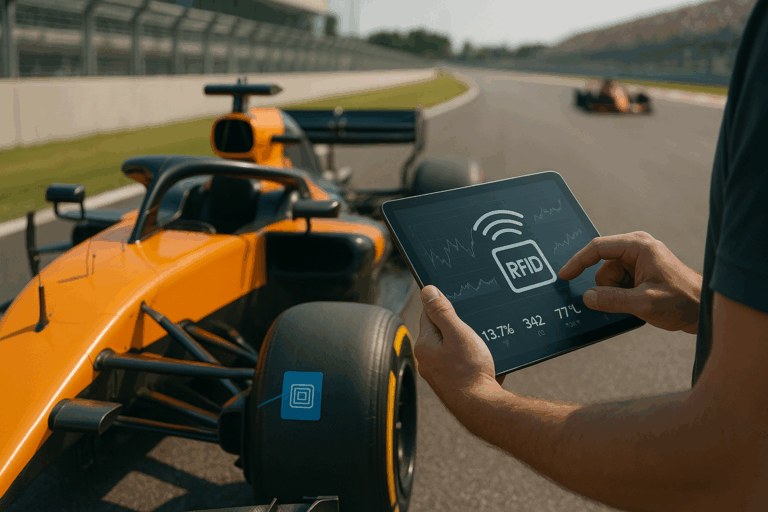

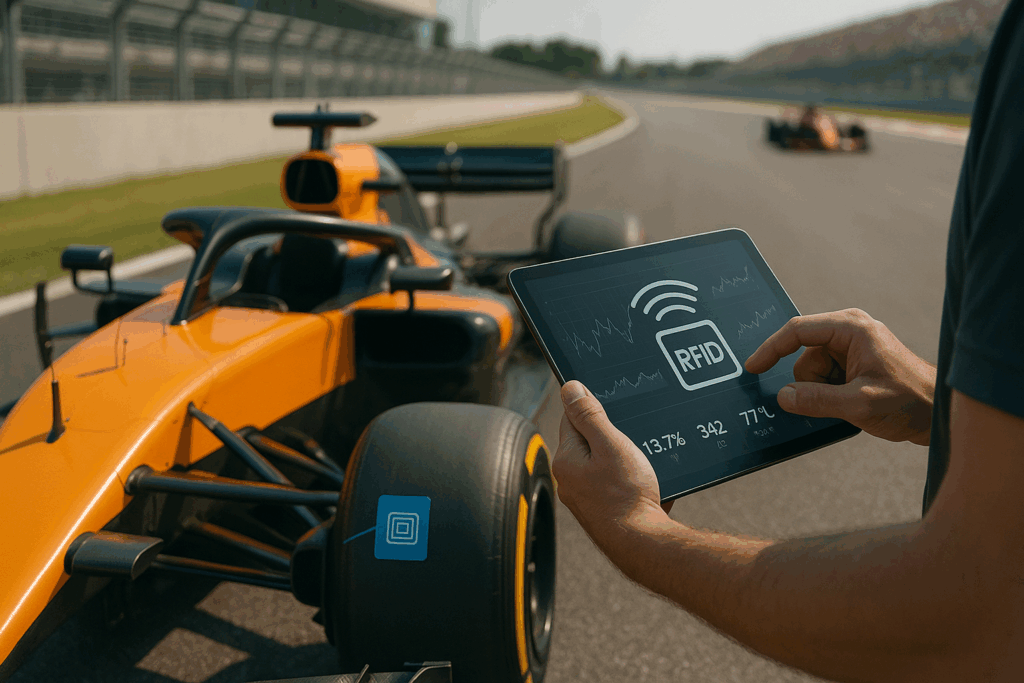

RFID Tracking Technology is rapidly transitioning from a niche role with specific digital transformation – for access control and monitoring – to part of a broader inventory control and asset tracking solution for financial and tax reporting.

Want to learn more about RFID Tracking Technology to automate manual processes of Fixed Asset Accounting and Control? Read this helpful guide for more information on how RFID Tracking identifies ghost assets and data gaps in asset records, uncovering significant property tax savings opportunities.

Table of Contents

ToggleWhat Is a Ghost Asset?

A ghost asset is a fixed asset that is listed on an organization’s financial records but is no longer in use or cannot be found. It is often the result of poor asset management practices, including inadequate record-keeping or lack of physical inventory checks. Ghost assets can be a significant issue for organizations, as they can lead to inaccurate financial statements, incorrect tax assessments, and increased costs due to the maintenance of unnecessary assets.

What Is the Leading Cause for Ghost Assets?

Inconsistent internal controls over fixed assets is the leading cause of ghost assets. These include the following:

- Inadequate asset descriptions including missing manufacturer, model and serial number information

- Bulk purchases of equipment

- Little or no use of property asset ID tags

- Inconsistent application of the capitalization threshold

- Construction-in-progress projects not properly segregated into building and equipment accounts

- Poor documentation of asset movement including disposal activity and transfers

- Assignment of unreasonable lives for depreciation calculations

- Infrequent or no periodic physical asset inventory and reconciliation

What Is the Accounting Cost of Ghost Assets?

Now, in the post-SOX and with the wider adoption of IFRS standards, fixed assets are often the largest item on the organization’s balance sheet. Depending on the resident state and county, an organization can be subject to personal property tax on fixed assets (vehicles, equipment, machinery, etc.). Tax assessment is based on the value of the asset and its tax rate is set by the local government – where the asset is located. Unfortunately, it is not uncommon for organizations to be overpaying taxes by 10% to 20%, because of “ghost assets” – which are property assets that no longer exist but are still on the books.

Likewise, fixed asset accounting records play a key role in determining replacement costs of property assets for insurance purposes. Insurance premiums are often based on the total value of an organization’s assets. Including ghost assets in the calculation can result in higher premiums, leading to increased expenses.

What Is RFID Tracking Technology and How Does It Work In Identifying Ghost Assets?

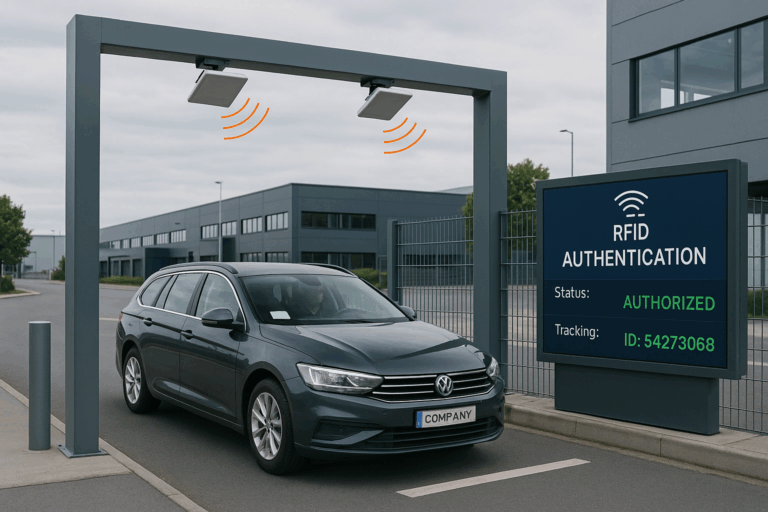

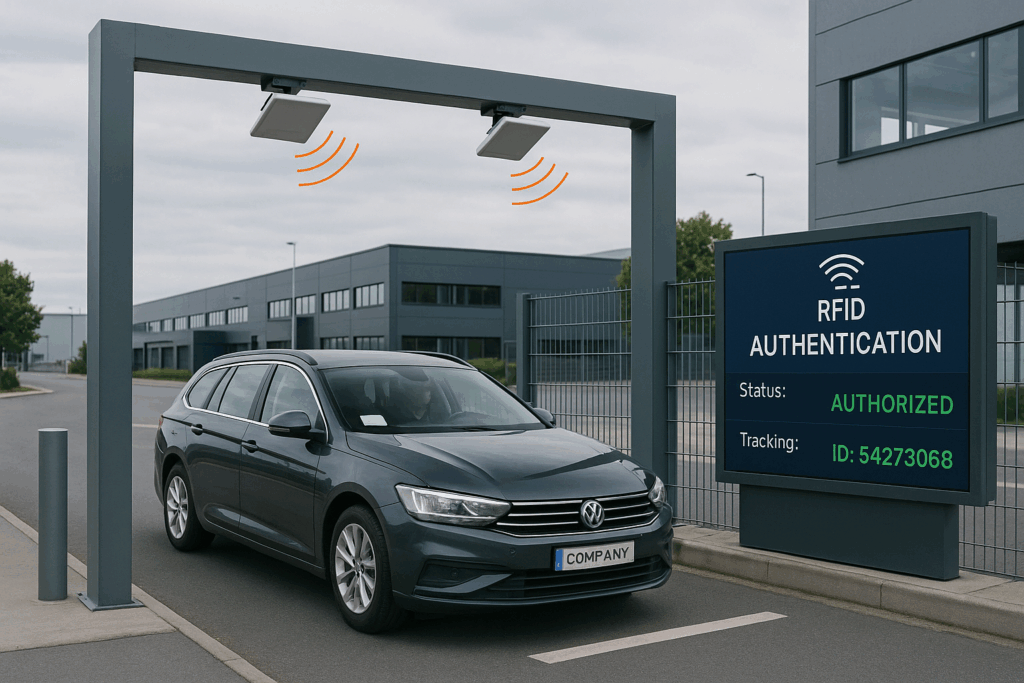

RFID (radio-frequency identification) is essentially a tracking technology that uses radio waves to communicate information between a Smart Tag or Label attached to an object and a reader (or fixed antenna). This Smart Tag contains a unique identifier that can be used to track the location and movement of the tagged objects. Utilizing from tracking technology of the RFID Tag to keep track of fixed asset existence and accounting records in real-time.

That is, in the context of property taxes, RFID tracking technology can be used to identify and track assets that are subject to tax. By attaching RFID tags to assets, organizations can create a real-time inventory of all their assets and records accurate logs of asset movement. With an RFID integration with ERP accounting systems, transaction codes can be programmed and automated to update fixed asset accounting records across the asset lifecycle – from acquisition to retirement. This can help identify and cleanse ghost assets, resulting in property tax savings.

RFID Automation Replaces Manual Processes In Fixed Asset Inventories and Audits / Reconciliation

Organizations face issues with incomplete or inaccurate fixed asset data – even, in some cases, having discrepancies in more than 50% of the fixed asset data. Fixed assets are managed across different locations and tax jurisdictions. This results in a growing volume of data that must be accurately tracked.

With RFIDs, organizations can bulk check in / out their fixed assets and locate them easily, even across multiple locations. The technology provides a continuous and accurate record of assets, which can be visualized in real-time by authorized personnel. Streamlining the process of conducting physical inventory audits by 25x faster data collection with more than 99.3% inventory accuracy, which reduces the time and effort required to reconcile inventory discrepancies. This can help organizations to save time and resources, while also minimizing the risks associated with manual data entry and human error.

RFIDs reduce the needs for manual data entry and streamline ERP Systems’ fixed asset data

By using RFID tracking technology, organizations can streamline their ERP (Enterprise Resource Planning) systems’ fixed asset data management processes. ERP systems with RFID integration can automatically update the fixed asset data in real-time as the assets are moved, tracked, and updated. This reduces the manual effort required for data entry and improves the accuracy and reliability of the data. RFID data collection (scanning) help organizations identify and respond to issues more quickly. Handheld RFID Scanners (or Fixed Antennas) can read and identify more than 100 Tags each second. All errors or discrepancies can be minimized or eliminated. RFIDs reduce the number of errors and improves accuracy of inventory, which leads to better inventory management and control.

Fixed Asset Tracking and Artificial Intelligence (AI) Reconciliation Tool with CPCON RFID

The most appropriate place to start is to reevaluate those business processes and internal controls you wish could be automated. For instance, one may choose to streamline Fixed Asset Tracking tasks with the implementation of RFID Systems to cleanse ghost assets, and thus, uncovering 10% to 20% savings in property tax opportunities.

By integrating RFIDs with ERP Systems, firms eliminate manual data entry, individual scanning, data verification (reconciliation), and asset searching. As well as creating real-time visibility for Asset Tracking and Management operations.

CPCON’s AI tool simplifies the fixed asset reconciliation processes by automating the matching and linking the physical inventory data with the corresponding asset accounting records, based off similarity testing of the database. Resulting in 10x faster cleansing and improved analysis of residual assets – including, but not limited to unrecorded retirements, unrecorded additions, and other matches.

Our Fixed Asset Advisory team has deep experience in reviewing and establishing asset capitalization policies for financial reporting, tax, insurance, and regulatory compliance. We can guide you through the accounting process. This can help you maximize value for your organization while remaining compliant with the latest regulations. Additional benefits include accurate property tax values, streamlined insurable taxes, improved financial reporting, and support Mergers and Acquisitions.

Contact us today to learn more.