The Sarbanes-Oxley Act (SOX) of 2002 was enacted to improve corporate governance and financial transparency in the wake of several high-profile accounting scandals. Section 404 of SOX requires publicly traded companies to establish and maintain internal controls over financial reporting. Many organizations underestimate the necessary scope of the documentation, evaluation, and testing efforts, as well as the staffing requirements, to successfully achieve compliance with section 404 of the Sarbanes-Oxley Act.

Table of Contents

ToggleThreats to Sarbanes-Oxley Section 404 Compliance

This article discusses the top five threats that organizations should be aware of and address to ensure ongoing compliance with SOX Section 404:

Absence of an Integrated Executive-Driven Internal Control Management

A strong and comprehensive internal control management program is crucial for achieving compliance with Section 404 of the Sarbanes-Oxley Act. This program should be enterprise-wide, executive-driven, and encompass all key processes related to financial reporting. Hiring and effectively managing qualified control specialists is essential for sustained compliance.

Additionally, the program should be directed and monitored at the CFO/CAO level, engage all relevant areas of the organization, establish a consistent internal control framework, promote documentation and evaluation standards, continuously monitor compliance, provide training and awareness, and ensure effective communication with executive management and the board of directors. Lack of such a program poses several threats, including doubts about executive commitment to effective internal control, potential material weaknesses going undetected, and the inability to sustain compliance in the future. Executives need to prioritize and invest in an enterprise-wide internal control management program to ensure ongoing compliance and effective internal control over financial reporting.

Lack of a Formal Risk Management Program

Establishing an enterprise risk management program is critical for the success of an internal control management program. This formal process helps identify and assess financial reporting risks, link them to specific areas and activities within the organization, assign responsibilities, and establish communication protocols. Implementing a formal risk assessment process demonstrates management’s commitment to compliance and allows for effective allocation of compliance resources. Performing regular risk assessments helps keep the organization’s risk profile aligned with its evolving business and satisfies regulatory requirements.

Key considerations include assigning responsibility for risk assessment, prioritizing and communicating risks consistently, mapping risks to business processes and individuals, ensuring employee understanding of risks and control activities, and having adequate technology to support risk management. A robust risk management program contributes to maintaining adequate internal control and meeting compliance obligations.

Inadequate Post-Merger Integration

Mergers and acquisitions present significant challenges in maintaining effective internal control. Companies often overlook internal control issues in the rush to integrate the new entity and achieve market synergies. Blending people, processes, and technologies in a short period of time creates internal control risks that are frequently neglected. The focus on cost reduction and integration can overshadow the need to establish a consistent internal control environment across the consolidated entity. This leads to varying controls in different sections of the organization, indicating a failure to establish an effective system of internal control throughout the organization. Neglecting internal control considerations during mergers and acquisitions exposes the organization to control weaknesses and gaps that may only be discovered late in the compliance process. It is crucial for companies to prioritize internal control integration as an integral part of the merger or acquisition process to ensure the establishment of a robust and consistent internal control framework.

Lack of effective controls over the IT environment

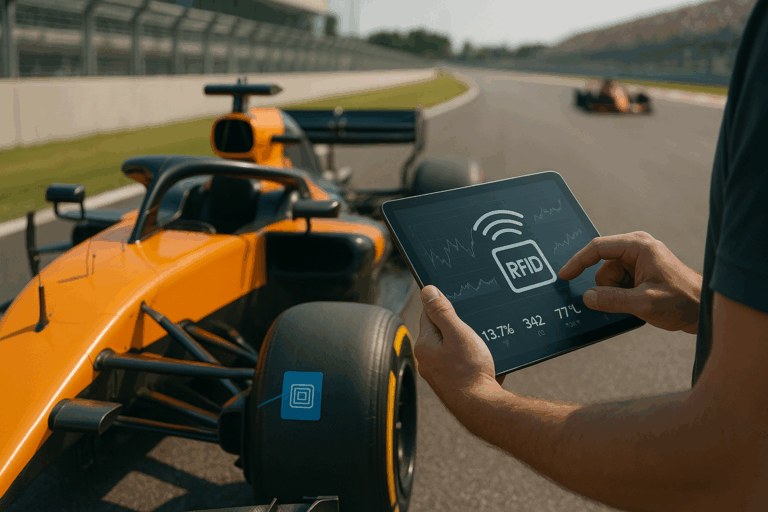

As organizations increasingly rely on technology for transaction execution and reporting, the complexity and maintenance of technology systems have grown. Section 404 compliance requires companies to evaluate and test their controls in the IT environment, revealing pervasive control issues that can hinder compliance efforts. Common areas of weakness in IT controls include systems development, data conversion, security technologies, and third-party IT service providers. To address these issues, organizations should establish an IT-specific internal control framework, consider the customization level of their IT environment, manage turnover rates in the IT department, address program maintenance backlogs, assess the effectiveness of ERP systems, streamline legacy systems, establish consistent IT standards, minimize manual control activities, and ensure an adequate segregation of duties in IT processes. Addressing these key questions and implementing robust IT controls are crucial for maintaining reliable financial reporting and achieving section 404 compliance.

Organizations should establish an IT-specific internal control framework to guide their section 404 compliance activities. They need to assess the customization level of their IT environment, as highly customized applications can be prone to control issues and lack vendor support. Monitoring turnover rates in the IT department is essential, as high turnover may indicate dissatisfaction with unreliable technology. A large backlog of program maintenance requests may suggest overly complex and unreliable systems.

If extensive rework or retrofitting of installed ERP systems is necessary, it can result in significant internal control gaps. Relying on disparate legacy systems for financial reporting increases complexity and risk, requiring additional efforts to consolidate information and manage controls. Establishing formalized and consistent IT standards throughout the organization reduces complexity and risk.

Manual control activities to compensate for IT weaknesses are inefficient and risky. Adequate segregation of duties in technology-enabled processes is crucial for maintaining strong internal control. Organizations must document the existence and enforcement of appropriate segregation of duties to satisfy section 404 requirements.

Additionally, implementing effective IT asset management practices ensures that technology resources are properly identified, tracked, and maintained. This includes inventorying hardware and software assets, establishing asset lifecycle management processes, implementing software license management, and ensuring data security and privacy measures are in place. By effectively managing IT assets, organizations can enhance control over technology systems, mitigate risks, and support section 404 compliance.

Deficient Financial Reporting and Disclosure Preparation Processes:

The increasing frequency and complexity of financial disclosures have posed challenges for companies, particularly regarding accurate preparation and organizational processes. Some companies lack the necessary technical accounting skills to ensure accurate disclosures, compounded by insufficient processes for collecting and organizing required information. Even companies with established processes may not adequately document or assess the related controls. The reliance on independent auditors for assistance has been common, but Sarbanes-Oxley section 404 now requires internal control audits of the financial disclosure preparation process. As a result, organizations are seeking specialized accounting capabilities to meet section 404 requirements and minimize compliance risks.

To evaluate compliance in this area, management should consider past reliance on external specialists for disclosure preparation, recommendations for changes from auditors during the audit process, and a history of frequent adjustments to disclosures. Lack of in-house capabilities, skills, and controls may be indicated. Formal documentation of the disclosure process and controls is essential to evaluate their design and operational effectiveness.

To ensure section 404 compliance and accurate financial disclosures, organizations need to address their technical accounting skills gap and establish robust processes for collecting and organizing information. Investing in specialized accounting capabilities, documenting the disclosure process, and rigorously evaluating and testing controls associated with the process are crucial steps to mitigate compliance risks and produce reliable financial disclosures.

Where to start if you think SOX Advisory can help

Compliance with Sarbanes-Oxley Section 404 is crucial for maintaining transparency and trust in financial reporting. Organizations must proactively address the threats to Section 404 compliance to ensure the effectiveness of their internal controls. By addressing the insufficient documentation, securing management support, enhancing testing and monitoring, adapting to technological changes, and managing outsourcing risks, organizations can mitigate the threats and achieve sustainable compliance with Section 404. Maintaining a robust compliance framework is not only essential for meeting regulatory requirements but also for safeguarding the long-term success and reputation of the organization.

The most appropriate place to start is to define the scope of your evaluation. Determine the boundaries of your Business Processes, and stakeholders involved. Clearly defining the scope will help you focus your efforts and ensure a comprehensive assessment.

Our Fixed Asset Advisory team has deep expertise in SOX Compliance.Each year, we provide advisory solutions – consisting of business process automation, consulting services, and advanced technology – to hundreds of clients in virtually every industry.

Contact us today to learn more.