Fixed asset management plays a vital role in the financial and strategic health of organizations. Among these assets, vehicles — from trucks and forklifts to corporate fleets — stand out as critical components of corporate value. They go beyond transportation, influencing cash flow, depreciation, and the company’s real worth. Efficient management ensures accurate accounting, cost reduction, and protection against losses. In this article, we will explain how treating vehicles as fixed assets can transform asset management into a true competitive advantage across different industries.

Table of Contents

ToggleWhat does it mean to classify vehicles as fixed assets?

In accounting and asset management, vehicles are more than just transportation tools. When used in company operations for over a year and with significant value, they are considered fixed assets. This includes trucks for logistics, service fleets, forklifts in distribution centers, and even corporate cars.

Viewing vehicles as fixed assets is strategic because:

- They are subject to depreciation, directly affecting accounting and tax results.

- They represent high-value investments that require maintenance and replacement planning.

- They are essential for operational continuity in industries such as logistics, healthcare, energy, and retail.

Without proper control, these assets can generate hidden costs — unnecessary maintenance, duplicate purchases, or even losses. With efficient management, however, companies gain financial predictability, reduce audit risks, and turn their fleet into a corporate asset that adds real value to the business.

Key impacts of vehicle management on corporate assets

The way a fleet is managed directly affects the value and overall health of corporate assets. When vehicles are treated as fixed assets, the impacts go far beyond accounting:

- Controlled depreciation: vehicles naturally lose value, and calculating depreciation correctly ensures transparent financial statements and tax compliance.

- Reduced operating costs: efficient asset management prevents unnecessary expenses with maintenance, fuel, or premature replacements.

- Audit traceability: maintaining accurate records of location, condition, and useful life protects the company from tax risks and audit issues.

- Investment planning: monitoring the lifecycle of vehicles allows for better replacement forecasts, contract renegotiations, and capital optimization.

- Company valuation: a structured asset management process builds credibility with investors and partners by demonstrating transparency and strong control of high-value assets.

In practice, the way vehicles are managed can be the difference between recurring losses and a well-structured asset cycle that generates efficiency, predictability, and a real competitive edge.

How to implement an efficient vehicle management system as fixed assets

Turning a fleet into a strategic asset requires more than recording vehicles on the balance sheet. It demands a structured management approach that combines processes, technology, and governance. The key steps include:

- Detailed physical inventory

Map the entire fleet, recording asset numbers, model, year, condition, location, and responsible user. - Accurate accounting classification

Ensure every vehicle is registered as a fixed asset, with depreciation criteria aligned to its useful life and accounting standards (such as IAS 16 / CPC 27). - Integration with corporate systems

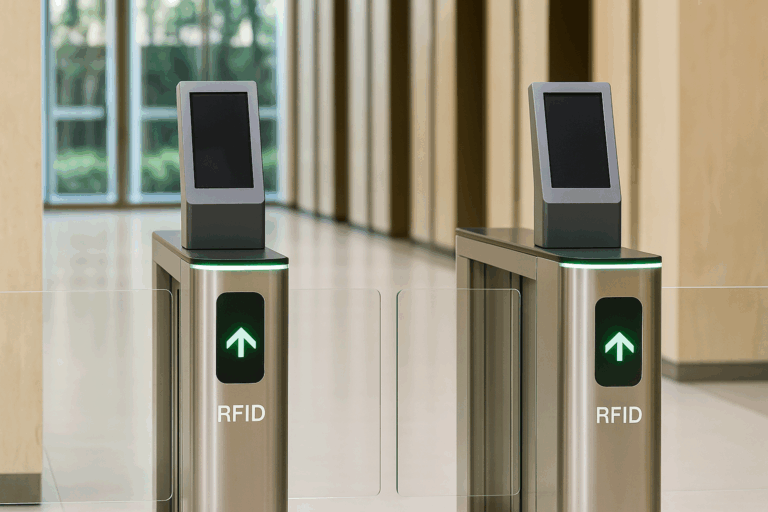

Adopt software that integrates with ERP or WMS, allowing automatic reconciliation between accounting data and operational information. - Adoption of advanced technologies

Tools like RFID tags and readers enable real-time tracking of vehicles and equipment, reducing the risk of fraud, theft, or inconsistencies during audits. - Lifecycle monitoring

Track maintenance costs, mileage, fuel consumption, and depreciation to plan replacements and avoid unexpected expenses. - Periodic audits and strategic reporting

Implement verification routines and dashboards that provide full visibility of the fleet’s impact on corporate assets.

With proper implementation, the system ensures tax compliance, greater operational efficiency, and smarter decision-making. The fleet stops being just an expense and becomes a valuable part of the company’s strategic assets.

Benefits of professional vehicle management as fixed assets

Companies that treat their fleet as a structured part of corporate assets unlock significant advantages. Professional vehicle management delivers measurable results that directly impact financial performance and organizational credibility:

- Reduced operating costs: fewer emergency repairs, optimized fleet usage, and elimination of hidden expenses.

- Financial predictability: more accurate projections of depreciation and replacements, enabling safer investment planning.

- Accounting and tax compliance: consistent records prevent penalties, strengthen governance, and simplify audits.

- Extended fleet lifespan: by tracking each vehicle’s cycle, companies implement preventive maintenance and reduce downtime.

- Credibility and transparency: detailed asset reports strengthen trust among investors, shareholders, and partners.

- Operational efficiency: with real-time traceability, vehicles remain available and strategically allocated.

When management is professionalized, vehicles stop being just a cost center and become strategic assets that drive growth, efficiency, and competitive advantage.

CPCON solutions for vehicle asset management

CPCON is a global leader in asset control, offering complete solutions for companies that want to professionalize vehicle management as fixed assets. Our approach combines advanced technology, specialized consulting, and over 25 years of industry expertise.

Key solutions include:

- RFID physical inventory: real-time fleet tracking with high accuracy and loss reduction.

- Physical-to-accounting reconciliation: ensuring fleet records match accounting systems and operational reality.

- Asset cleansing: identifying and eliminating inconsistencies to build a reliable asset base.

- Integrated asset management software: lifecycle control of vehicles, automated depreciation, and strategic reporting.

- Asset valuation: fair value assessment of vehicles, strengthening audits and financial planning.

- Specialized consulting: technical team ready to adapt methodologies to the specific needs of industries such as logistics, energy, healthcare, and retail.

With CPCON, your fleet becomes a strategic part of corporate assets, ensuring compliance, efficiency, and a true competitive edge.

Conclusion

Managing vehicles as fixed assets goes far beyond recording them on the balance sheet. It is a strategy that strengthens corporate assets, ensures financial predictability, and reduces fiscal and operational risks. When properly implemented, this control transforms the fleet into a competitive advantage.

CPCON is a global leader in asset management, supporting companies across all industries with RFID technology, integrated software, and specialized consulting. With CPCON, vehicles stop being just an expense and start generating real value for the business.

FAQ

What qualifies vehicles as fixed assets?

Vehicles used in company operations for more than one year, with significant value, and not intended for resale.

How does vehicle depreciation affect corporate assets?

It gradually reduces the accounting value of the fleet and directly impacts financial and tax results.

Why use RFID for managing vehicles as fixed assets?

Because it ensures real-time traceability, reduces the risk of losses, and increases inventory accuracy.

What is the difference between fleet control and managing vehicles as fixed assets?

Fleet control focuses on logistics and daily use. Asset management covers depreciation, accounting, audits, and overall corporate asset impact.

Get to Know CPCON Group: A global expert in asset management and inventory solutions

CPCON Group is a global leader in asset management, fixed asset control, and RFID technology. With over 25 years of experience, we have supported major companies such as Nestlé, Pfizer, Scania, BASF, Coca-Cola Andina, Vale, Vivo, Petrobras, and Caixa in high-complexity projects.

Curious about our global footprint? We are present in:

- North America: Toronto, New York, Miami, Minneapolis, Seattle, Dallas

- Latin America: São Paulo, Buenos Aires, Lima, Bogotá, Mexico City

- Europe: Lisbon, Porto, London, Birmingham, Milan, Rome, Turin, Madrid, Bilbao

- Middle East: Dubai, Saudi Arabi

- Caribbean: Tortola, Grand Cayman

Follow our LinkedIn Showcase Page and stay updated with strategic content on asset control, inventory management, and RFID innovation across industries.

Managing vehicles as fixed assets ensures accurate depreciation, financial predictability, and compliance. With RFID technology, software, and consulting, CPCON turns fleets into strategic assets that reduce costs and strengthen corporate value.