Table of Contents

ToggleTechnology, traceability, and efficiency: how UHF RFID hang tags are reshaping global apparel retail.

Reading time: 12–14 minutes

Imagine having complete control over your apparel inventory — tracking every item in real time, reducing losses, and accelerating your supply chain. This is no longer a future trend. It’s happening now. The global UHF RFID clothing hang tag market was valued at USD 5.24 billion in 2023 and is projected to reach USD 15.79 billion by 2032, growing at a CAGR of 13.04%, according to WiseGuyReports.

This growth is driven by retail digitalization, increasing demand for omnichannel operations, and the strategic adoption of RFID in the fashion industry. Global brands like Levi’s, Walmart, and Zara have already proven its value — and now, companies of all sizes are seeking advanced solutions to boost efficiency, reduce shrinkage, and gain real-time visibility.

At The CPCON Group, we’ve been at the forefront of this transformation. With over 25 years of experience in asset management and RFID technology, we empower apparel brands to evolve with precision, agility, and total control. In this report, we explore the full scope of the UHF RFID clothing hang tag market — including trends, segmentation, use cases, and strategic insights from our expert team.

UHF RFID Clothing Hang Tag Market Overview

The UHF RFID clothing hang tag market has entered a period of rapid global expansion — driven by digital transformation in retail, the rise of omnichannel sales, and increasing demand for operational transparency. These small, high-frequency tags are now essential to item-level inventory tracking, helping retailers stay agile and competitive in a fast-moving environment.

According to recent market intelligence, the segment was valued at USD 5.24 billion in 2023 and is expected to grow to USD 15.79 billion by 2032, reflecting a Compound Annual Growth Rate (CAGR) of 13.04% over the forecast period.

| Metric | Value |

| Market Size (2023) | USD 5.24 billion |

| Projected Market Size (2032) | USD 15.79 billion |

| CAGR (2024–2032) | 13.04% |

This strong growth reflects increasing RFID adoption across sectors — particularly in apparel and fashion, where real-time inventory visibility has become non-negotiable. Retailers are shifting away from manual and barcode systems toward more scalable, automated, and data-rich solutions.

Key Growth Drivers

- Rising demand for item-level inventory visibility

- Increased pressure for accurate stock replenishment across channels

- Adoption of RFID in fashion retail and logistics

- Sustainability goals and regulatory compliance (e.g., EU Digital Product Passport)

The Strategic Role of UHF RFID in the Apparel Industry

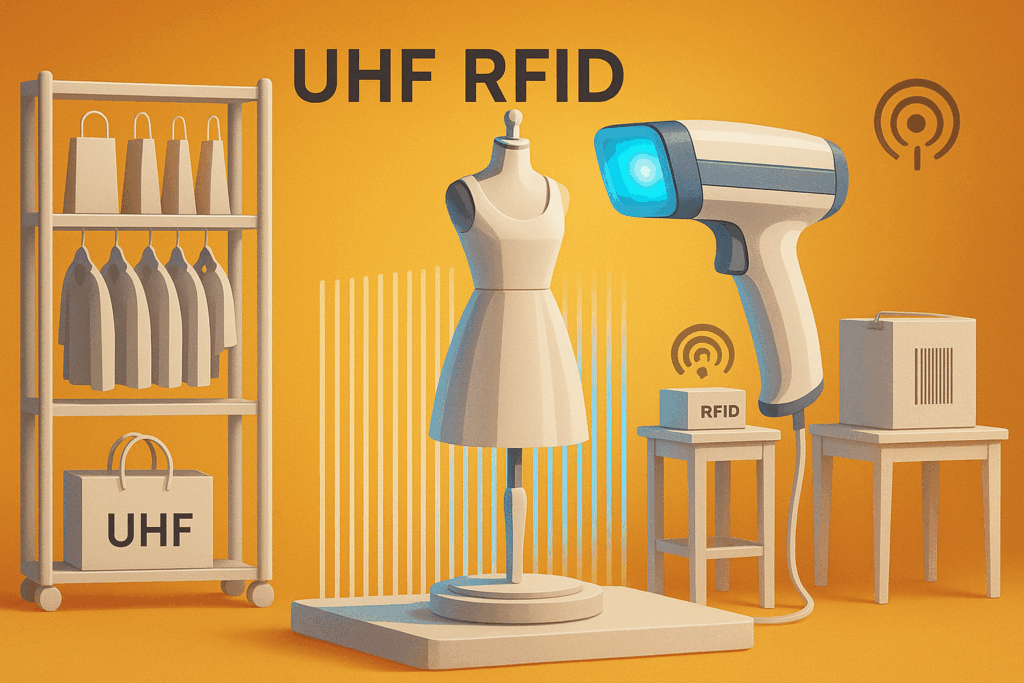

UHF RFID technology is no longer a futuristic concept — it’s a practical tool that’s changing how fashion and apparel companies manage their inventory, reduce losses, and improve customer experience. In a fast-paced industry, visibility and speed matter. UHF RFID tags make both possible.

Why RFID Tags Matter in Fashion

UHF RFID tags are small devices that store and transmit data using ultra-high frequencies (860–960 MHz). When attached to clothing tags, they allow retailers and logistics teams to track each item across the supply chain — from production to the sales floor — without needing direct line of sight.

Here’s how they’re making a difference:

- Real-time inventory updates: No more manual counts. RFID lets you know exactly what’s in stock — instantly.

- Faster replenishment: Stores avoid out-of-stock issues by getting accurate sales data in real time.

- Improved customer experience: RFID powers smart fitting rooms, automated checkouts, and personalized recommendations.

- Brand protection: RFID helps fight counterfeiting by ensuring traceability throughout the product’s life cycle.

The Walmart Effect

When Walmart announced in 2020 that it would require RFID tagging on all apparel items, it sent a clear message: RFID is essential. Since then, adoption has skyrocketed across the retail sector. Companies of all sizes now rely on RFID to streamline operations and stay competitive.

Key Market Drivers and Trends

The rapid growth of the UHF RFID clothing hang tag market is not by chance. It’s the result of major shifts happening in retail and manufacturing — where visibility, speed, and control are no longer optional. Here are the three main forces pushing this transformation forward:

1. Smarter Inventory, Better Results

Retailers are under constant pressure to reduce costs, avoid stockouts, and deliver faster. Manual inventory methods simply can’t keep up. UHF RFID tags solve this by providing accurate, real-time inventory data across stores, warehouses, and distribution centers.

This means fewer losses, better forecasting, and faster decision-making — especially in fashion retail, where product cycles move quickly and timing is everything.

2. The Rise of Smart Clothing and Connected Products

Wearables and tech-enabled fashion are on the rise. UHF RFID tags are the backbone of this evolution. They make it easier to connect clothing to mobile apps, loyalty programs, or even washing instructions via the Internet of Things (IoT).

For brands, this opens the door to personalized shopping experiences, improved customer retention, and new revenue streams — all through a simple hang tag.

3. Sustainability and New Regulations

Governments, especially in the EU, are introducing new rules that require more transparency in product sourcing and manufacturing. UHF RFID tags help companies meet these demands by tracking materials, recycling information, and supply chain data at the item level.

Initiatives like the Digital Product Passport are accelerating RFID adoption across Europe, making it not only a smart investment — but a necessary one.

Market Segmentation by Tag Type

Not all RFID tags are the same — and that matters, especially in fashion. Each tag type has its own features and best-use scenarios. Choosing the right one can impact everything from cost to durability and performance.

At The CPCON Group, we help brands identify the best tag for their materials, product types, and operating environments. Here’s a breakdown of the most common tag formats in the UHF RFID apparel market:

Hard Tags

These are rigid, durable tags often used in industrial or high-impact environments. They’re ideal for items that need to be reused or face rough handling — like rental clothing, workwear, or returnable packaging.

Key advantage: Long lifespan and high resistance.

Soft Tags

Flexible and lightweight, soft tags are perfect for everyday retail and healthcare applications. They can be attached directly to clothing without affecting comfort or aesthetics.

Key advantage: Discreet and adaptable to different fabric types.

Printable Tags

These tags can be custom printed with branding, QR codes, or SKU details. They offer both digital tracking and a physical touchpoint, making them great for promotional items or private label products.

Key advantage: Personalization and quick deployment.

Textile (Woven-In) Tags

Woven directly into the garment, these tags are widely used in high-end fashion and uniforms. They stay in place even through industrial washing cycles and provide reliable identification for the entire product life.

Key advantage: Seamless integration with the garment.

Market Segmentation by Frequency

In RFID technology, frequency matters — and understanding the difference helps businesses choose the right system for their needs. In the apparel sector, UHF (Ultra High Frequency) has become the standard, but HF (High Frequency) tags still play a role in certain contexts.

Let’s break it down in simple terms.

UHF (Ultra High Frequency)

This is the most widely used RFID type in fashion and retail. UHF tags operate between 860 and 960 MHz, which allows them to read dozens — or even hundreds — of items at once, from several meters away.

Why retailers choose UHF:

- Fast scanning speeds

- Longer read range (up to 40 feet)

- Lower cost per tag compared to HF

- Ideal for inventory, logistics, and checkout automation

Because of these benefits, UHF is the go-to choice for large-scale apparel operations looking to manage stock in real time.

HF (High Frequency)

HF tags work at a shorter range (usually a few centimeters), which makes them better for contact-based interactions, such as access control or secure data transfers. They’re often used in loyalty cards, tickets, or payment systems.

In fashion, HF tags are less common, but may be used in specialty cases where close-range reading is required or where space is limited.

Applications of UHF RFID Clothing Hang Tags

UHF RFID clothing hang tags are more than just tracking tools — they’re powerful enablers of efficiency, security, and customer engagement in the apparel industry. Here’s how they’re being used by retailers and brands around the world:

1. Real-Time Inventory Management

Managing stock accurately is one of the biggest challenges in fashion. With RFID, retailers can instantly see what’s in stock, where it is, and how fast it’s selling — across stores, warehouses, and even online.

Benefits:

- Avoid overstock or stockouts

- Speed up replenishment

- Simplify audits and inventory counts

- Reduce manual errors

2. Theft Prevention and Loss Control

UHF RFID tags act as a security layer for valuable items. They trigger alerts at exit points and offer better visibility into high-risk products.

Benefits:

- Track each item’s last known location

- Prevent internal and external theft

- Identify patterns and improve security protocols

3. Better Customer Experience

RFID is also changing how people shop. Smart hang tags enable features like:

- Self-checkout with no scanning

- Smart fitting rooms that recommend other items

- Instant product info via mobile apps

These innovations make shopping faster, smoother, and more personalized — turning first-time buyers into loyal customers.

Regional Market Outlook

The demand for UHF RFID clothing hang tags is rising across all global regions, but each market presents its own pace and characteristics. Understanding where adoption is growing faster helps companies plan their expansion strategies and prioritize investments.

North America

North America remains one of the most mature markets for RFID in apparel. Retail giants in the United States and Canada have led adoption, driven by the need for better inventory visibility and supply chain performance.

This region continues to invest in automation, omnichannel logistics, and item-level tracking, with high levels of integration between physical stores and digital platforms.

Europe

In Europe, the growth of RFID is supported by new sustainability regulations and supply chain transparency laws. Initiatives such as the Digital Product Passport are making RFID tags essential for compliance.

Countries like Germany, France, and the United Kingdom are leading RFID implementation in fashion retail, with widespread adoption among both premium and fast-fashion brands.

Asia-Pacific

The Asia-Pacific region shows the fastest growth in the RFID apparel market. Countries like China, South Korea, and Japan are investing heavily in retail technology to meet growing consumer demand and improve logistics efficiency.

This region benefits from strong manufacturing ecosystems, which makes RFID deployment more accessible and cost-effective. Emerging economies in Southeast Asia are also exploring RFID as they modernize retail and supply chains.

Latin America, Middle East, and Africa

These regions are in earlier stages of adoption, but momentum is building. As more retailers in these markets realize the benefits of RFID — such as better stock control and loss prevention — demand is expected to grow steadily.

Competitive Landscape

The global market for UHF RFID clothing hang tags is highly competitive and continues to evolve quickly. As more retailers and manufacturers adopt RFID, solution providers must combine innovation with operational expertise to stay ahead.

Several companies lead the development of RFID tags, readers, and integrated systems. Each brings its own strengths, but only a few combine deep technical knowledge with real-world application in the apparel industry.

Leading Companies in the Market

Among the main players in this space are:

- Avery Dennison

- Checkpoint Systems

- Zebra Technologies

- Alien Technology

- Impinj

- SML Group

- HID Global

These companies specialize in RFID hardware, software, or label production. Many offer complete product lines for retail and logistics, and some have developed partnerships with global fashion brands to integrate RFID into their operations.

The Role of CPCON

While many players focus on manufacturing tags or selling equipment, The CPCON Group brings a different value: we deliver complete, customized RFID solutions focused on results.

With more than 25 years of experience in asset management and control systems, CPCON offers not only the technology, but the operational intelligence to apply it effectively. Our role goes beyond supplying components — we design RFID strategies, implement end-to-end systems, and provide ongoing support to ensure your operations run with maximum efficiency and accuracy.

We have helped companies across the apparel sector adopt RFID with measurable results: improved inventory accuracy, reduced losses, and better decision-making based on reliable data.

Product Innovations and Technology Trends

The UHF RFID clothing hang tag market is not only growing — it’s evolving. New technologies are expanding what RFID can do, helping retailers and manufacturers go beyond basic tracking and into real-time intelligence.

Here are some of the most important innovations shaping the future of the industry.

Advanced Tag Performance

Modern UHF RFID tags are more durable, smaller, and easier to apply. Some models now include special materials that resist heat, industrial washing, or friction — making them ideal for workwear, rental uniforms, and items that need to be reused many times.

Tag designs have also improved. Smaller antennas and optimized chip layouts ensure that tags can be read faster and from longer distances, even when applied to soft fabrics or folded garments.

Integration with IoT and Data Platforms

RFID is increasingly part of a broader ecosystem. When connected to IoT platforms, RFID tags can send data directly to inventory systems, ERP software, or business intelligence dashboards. This allows companies to:

- Track items in real time

- Analyze customer behavior

- Trigger automatic reordering

- Personalize in-store experiences

This level of integration turns each item into a data point — making inventory more than just a number on a shelf.

Dual-Frequency and Sensor Tags

Some newer tags combine UHF with NFC, allowing interaction with both store systems and customer smartphones. Others include sensors to measure temperature, humidity, or product handling. These features are especially useful in logistics or for high-end items that require controlled storage and transport.

These innovations support both operational efficiency and sustainability. For example, washable tags enable circular models like clothing rental or recycling — aligned with growing environmental demands.

Challenges and Opportunities

As the market for UHF RFID clothing hang tags expands, companies face both technical and operational challenges. However, with the right guidance, these barriers can be converted into competitive advantages.

Main Challenges

1. Integration with existing systems

Many retailers still use outdated inventory tools or disconnected platforms. Integrating RFID requires planning, especially to ensure compatibility with current ERPs and POS systems. Without this, gains in efficiency can be limited.

2. Concerns about data privacy

Some companies worry about how RFID data is collected and protected. This is especially relevant in customer-facing applications. The solution lies in well-designed systems with clear privacy protocols.

3. Tag durability and performance

Tags that are poorly applied or exposed to harsh environments may lose effectiveness. That’s why choosing the right tag type for the use case — and testing it properly — is essential.

Where the Opportunities Are

1. Inventory efficiency

With real-time stock visibility, businesses reduce errors, accelerate restocking, and prevent lost sales. This leads to better margins and faster operations.

2. Growth in emerging markets

Countries in Asia, Latin America, and Africa are expanding their retail sectors. As these regions modernize, RFID adoption is accelerating — creating opportunities for early movers.

3. Support for sustainability goals

RFID enables traceability from production to recycling. This helps companies comply with new regulations and respond to consumer demand for transparency.

Future Outlook and Market Projections

The UHF RFID clothing hang tag market is set for continuous growth over the next decade. What started as a tool for basic inventory control has become a key part of digital transformation in retail.

Key Trends for the Coming Years

- Growing adoption in retail: RFID is now used in about 20% of all clothing items worldwide. This number is expected to increase quickly, especially among mid-sized and regional retailers.

- Expansion of item-level tracking: More brands are tagging individual products, not just boxes or pallets. This improves inventory accuracy, sales data, and customer service.

- Integration with AI and analytics: RFID will connect directly to systems that generate forecasts, track shopper behavior, and trigger automated responses — from restocking to marketing actions.

- Environmental impact: RFID will help brands meet sustainability goals by enabling better product traceability, waste reduction, and recycling processes.

By 2028, experts estimate that over 115 billion RFID tags will be in use globally each year. The retail sector will continue to lead this growth.

Supply Chain Structure

The supply chain behind UHF RFID clothing hang tags involves several specialized players. Understanding this structure helps companies choose reliable partners and ensure efficient implementation.

1. Raw Material Suppliers

These are the companies that produce the core components of RFID tags — chips, antennas, adhesives, and protective layers. The quality of these inputs directly affects tag performance, durability, and read accuracy.

2. Tag Manufacturers

Manufacturers combine the components to produce the actual RFID tags. They develop tags for different materials, environments, and product types. Some offer custom sizes, designs, or branding.

CPCON works closely with leading manufacturers to ensure the right tag is selected for each customer’s needs — whether for retail stores, warehouses, or industrial laundry.

3. Technology Integrators

This is where CPCON operates. Integrators are responsible for designing complete RFID systems — combining hardware (readers, antennas), software (platforms, dashboards), and field implementation.

We ensure all parts of the system work together, from the tags on the items to the reports on your screen. That’s what transforms RFID from a tool into a real business solution.

4. Distributors and Logistics Partners

Distributors deliver tags and devices to retailers and manufacturers. They may also offer local technical support and stock replenishment services. Efficient logistics keeps implementation on schedule and minimizes downtime.

5. End Users

These are the fashion brands, retailers, and logistics companies that apply RFID in daily operations. They rely on the entire supply chain to deliver a system that is stable, easy to use, and scalable.

Conclusion

UHF RFID clothing hang tags are no longer optional — they are a key asset for any apparel business that wants control, agility, and visibility across its operations. From inventory accuracy to theft prevention and smarter customer experiences, RFID delivers measurable results.

Major brands like Levi’s have already proven its value, tagging over 50 million products and reaching more than 98% inventory accuracy. But this technology is not just for global giants. With the right strategy, any company can benefit.

At The CPCON Group, we help businesses adopt RFID in a way that fits their reality. We don’t just sell tags or devices — we design end-to-end solutions, implement them with precision, and make sure they deliver results.

If your goal is to improve inventory control, reduce losses, or get ready for the next stage of retail innovation, our team is ready to support you.

FAQ

What is the current size of the UHF RFID clothing hang tag market?

In 2023, the market was valued at USD 5.24 billion. It is expected to reach USD 15.79 billion by 2032, growing at an annual rate of 13.04%.

Why are UHF RFID tags important for the apparel industry?

They allow companies to track each item in real time, reduce inventory errors, prevent losses, and improve the shopping experience — all from a simple tag attached to the product.

What types of RFID tags are used in clothing?

There are four main types: hard tags (durable), soft tags (flexible), printable tags (customizable), and textile tags (woven into garments). Each has different uses depending on the fabric, environment, and retail goals.

What are the main challenges in using RFID in retail?

The main challenges are system integration, data privacy concerns, and choosing the right tags for specific applications. With the right partner, these issues can be solved effectively.

Get to Know CPCON Group: A global expert in asset management and inventory solutions

CPCON Group is a global leader in asset management, fixed asset control, and RFID technology. With over 25 years of experience, we have supported major companies such as Nestlé, Pfizer, Scania, BASF, Coca-Cola Andina, Vale, Vivo, Petrobras, and Caixa in high-complexity projects.

Curious about our global footprint? We are present in:

- North America: Toronto, New York, Miami, Minneapolis, Seattle, Dallas

- Latin America: São Paulo, Buenos Aires, Lima, Bogotá, Mexico City

- Europe: Lisbon, Porto, London, Birmingham, Milan, Rome, Turin, Madrid, Bilbao

- Middle East: Dubai, Saudi Arabi

- Caribbean: Tortola, Grand Cayman

Follow our LinkedIn Showcase Page and stay updated with strategic content on asset control, inventory management, and RFID innovation across industries.

This article analyzes the global UHF RFID clothing hang tag market, with a focus on its rapid growth, key applications, and strategic impact in the apparel industry. The market was valued at USD 5.24 billion in 2023 and is projected to reach USD 15.79 billion by 2032, growing at a 13.04% CAGR.

The content explains how UHF RFID tags enable real-time inventory tracking, loss prevention, omnichannel operations, and customer engagement. It outlines market segmentation by tag type (hard, soft, printable, textile), frequency (UHF vs HF), and application (inventory control, theft prevention, in-store experience). Regional trends are covered, with North America and Europe leading adoption and Asia-Pacific showing the fastest growth.

The article also addresses main challenges, such as integration and privacy, and highlights innovations like dual-frequency tags, IoT integration, and washable designs for sustainability. The CPCON Group is positioned as a global leader in RFID strategy, offering end-to-end solutions tailored to apparel retailers and manufacturers.