Have you ever wondered how auditors can be sure that a company’s buildings, machinery, or vehicles actually exist? In financial audits, audit evidence is the solid proof that confirms fixed assets are real, properly recorded, and in line with accounting standards. Without reliable audit evidence, companies risk misstatements, fraud, and compliance failures that can damage both their balance sheet and their reputation.

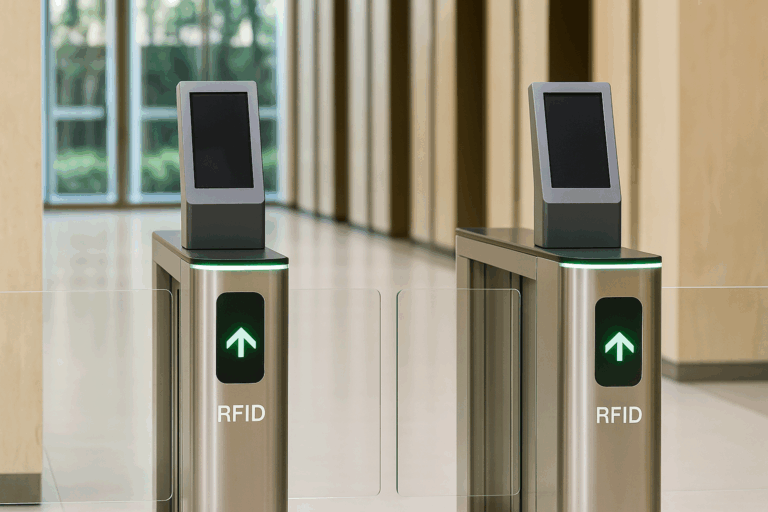

Imagine walking through a warehouse with an auditor, scanning RFID tags, checking serial numbers, and matching each item against official records. Every step, photo, and document collected builds a chain of trust—proof that the assets on paper truly exist in the real world. In this article, we’ll explore the key methods, technologies, and best practices auditors use to verify fixed assets with confidence, ensuring transparency, accuracy, and stakeholder trust.

Table of Contents

ToggleUnderstanding Audit Evidence in Fixed Asset Verification

Audit evidence is the backbone of any fixed‑asset audit: it’s the information an auditor uses to conclude whether the assets on the balance sheet truly exist and are recorded properly. Strong audit evidence must be sufficient (enough quantity) and appropriate (relevant and reliable) to support the conclusion.

What “audit evidence” means in practice

In plain terms, audit evidence is any information—inside or outside the company—that helps confirm what the financial statements claim about fixed assets. This includes documents, observations, confirmations, analytics, and data from technology‑enabled procedures. Standards like PCAOB AS 1105 and the ISA 500 series guide how auditors design procedures to obtain and evaluate that evidence.

The core types of evidence (kept simple)

- Documentary: purchase orders, supplier invoices, title deeds, lease agreements, insurance policies.

- Physical: on‑site inspection of equipment, buildings, vehicles; condition checks; photos.

- Testimonial: explanations from asset custodians and process owners; third‑party confirmations when needed.

- Analytical: reasonableness checks (e.g., capacity vs. output), trend and ratio analysis, roll‑forwards and roll‑backs.

What “good” audit evidence looks like

- Relevant to the existence objective (does it prove the asset is there?).

- Reliable, considering the source (independent sources often carry more weight) and how it was obtained (direct auditor observation is strong).

- Timely, covering the audit period without gaps.

- Traceable to the asset register and general ledger (clear audit trail from tag/serial → register → ledger).

How this applies to fixed assets specifically

For property, plant and equipment (PPE), IAS 16 sets the accounting foundation—recognition, measurement and depreciation. In the audit, evidence must connect the recorded item to a real, usable asset that meets IAS 16’s definition (e.g., held for use, used over more than one period). Typical evidence bundles include the purchase contract and invoice, proof of ownership or right‑of‑use, physical inspection notes and photos, tag/serial match to the register, and where applicable, site or GIS evidence for land and large facilities.

A quick checklist auditors (and you) can use

- Does each asset in the register have a unique identifier (tag/serial) that matches what’s on the shop floor?

- Is there documented ownership/right‑of‑use (title, lease, or contract)?

- Is there recent physical evidence (inspection notes, photos, condition) tied to the ID?

- Do depreciation schedules and location data make sense for how the asset is used?

- Are technology logs (e.g., RFID scans) and system records exportable and kept as part of the audit trail?

Core Methods to Verify the Existence of Fixed Assets

Verifying fixed assets is not a single action — it’s a sequence of checks that, together, create undeniable proof that what’s in the books exists in the real world. In practice, auditors combine different methods to build a complete, reliable picture.

1. Physical inspections: seeing is believing

The strongest audit evidence often comes from physically observing the asset. This means visiting the warehouse, plant, or office and confirming:

- The asset is present and in usable condition.

- Its identification tag or serial number matches the asset register.

- The location aligns with internal records and operational use.

2. Reviewing documentation: the paper trail

Physical presence isn’t enough — the asset must also be backed by ownership or usage rights. Auditors review:

- Purchase invoices and contracts to prove acquisition.

- Title deeds or lease agreements for legal rights.

- Insurance records to confirm protection against risks.

This “paper trail” links the asset’s physical reality to its legal and financial identity.

3. Asset tagging and identification

Every fixed asset should have a unique identifier — a tag, plate, or embedded RFID chip. This allows:

- Quick verification during audits.

- Easier tracking of location and condition over time.

- Automatic reconciliation between the physical count and the accounting records.

4. Analytical procedures

Sometimes, discrepancies are not obvious in the warehouse but show up in the numbers. Auditors use:

- Depreciation analysis — checking if the asset’s recorded age and value make sense.

- Ratio comparisons — such as output per machine or cost per square meter.

- Trend reviews — spotting sudden changes in asset counts or valuations.

These techniques help detect anomalies before they become problems.

Leveraging Technology for Accurate and Efficient Verification

In asset verification, technology has moved from being an optional support to becoming a core audit tool. For companies with thousands of assets spread across multiple locations, it’s the difference between a slow, error-prone process and a fast, reliable one.

1. RFID: the game changer

Radio-Frequency Identification (RFID) allows auditors to verify large volumes of assets without touching each one individually. By scanning RFID tags, an auditor can:

- Capture asset data in seconds.

- Verify location and status automatically.

- Maintain a digital record for the audit trail.

2. Barcode scanning: practical and affordable

While RFID offers greater automation, barcode technology remains a reliable and cost-effective option for smaller inventories or organizations transitioning to full RFID. Benefits include:

- Universal compatibility with handheld and mobile scanners.

- Quick cross-check with accounting records.

- Immediate discrepancy alerts when data doesn’t match.

3. GIS mapping for large-scale assets

For land, buildings, and infrastructure, auditors increasingly rely on Geographic Information Systems (GIS). GIS combines:

- Satellite imagery.

- Property boundary data.

- Asset location coordinates.

4. Integrated digital asset management systems

Modern audits benefit from systems that centralize asset data, allowing:

- Instant reporting on verification progress.

- Integration with ERP and financial systems.

- Secure cloud storage of supporting evidence — from contracts to inspection photos.

Analyzing Depreciation and Independent Valuation Reports

Depreciation and valuation reports are not just accounting formalities — they are powerful sources of audit evidence that confirm whether fixed assets truly exist and retain their expected value.

1. Depreciation schedules: tracking an asset’s life cycle

Every fixed asset has a story: when it was acquired, how it’s used, and how its value decreases over time. Depreciation schedules help auditors verify:

- If the asset’s useful life is consistent with its physical condition.

- Whether the method of depreciation (straight-line, units of production, etc.) follows IFRS or GAAP standards.

- If accumulated depreciation aligns with the asset’s age and usage.

2. External valuation: an independent perspective

Bringing in independent valuation experts adds credibility to the verification process. These professionals:

- Inspect the physical asset.

- Assess its condition and remaining useful life.

- Compare its market value with the recorded book value.

3. How these reports tie to asset existence

Depreciation analysis and external valuations don’t just validate the value of the asset — they also confirm its existence.

- If a valuation report includes recent on-site inspections, photos, and serial number checks, it becomes direct audit evidence.

- If depreciation schedules show logical and consistent use, they indirectly support that the asset is still in service.

4. Best practices for companies

- Keep depreciation schedules updated monthly, not just at year-end.

- Maintain a file with the latest external valuation reports for critical assets.

- Integrate valuation data into your asset management system so auditors can cross-check in real time.

Compliance with IFRS, GAAP, and Local Audit Standards

In asset verification, following established accounting standards is not optional — it’s the foundation that ensures financial information is credible, comparable, and audit-ready.

1. Why compliance matters for asset existence

Standards like IFRS (International Financial Reporting Standards) and GAAP (Generally Accepted Accounting Principles) set the rules for how assets are recognized, measured, and disclosed. When companies align their asset verification processes with these rules, they:

- Increase stakeholder confidence.

- Reduce the risk of regulatory penalties.

- Facilitate smoother external audits.

2. Core documentation requirements

Auditors expect to see a complete and well-organized set of documents, including:

- Acquisition records (invoices, contracts, title deeds).

- Proof of ownership or right of use (leases, licenses).

- Maintenance and insurance records.

- Depreciation and impairment reports.

Keeping this documentation centralized and accessible is critical for fast and efficient audits.

3. Internal controls that support compliance

Strong internal controls create a continuous state of audit readiness:

- Regular reconciliations between physical counts and the asset register.

- Segregation of duties to avoid conflicts of interest in asset management.

- Automated tracking through RFID or barcode systems for reliable logs.

These controls align with compliance frameworks and reduce discrepancies that could trigger audit exceptions.

4. How CPCON supports compliance globally

As a partner in asset management and verification, CPCON integrates technology, process design, and compliance expertise to:

- Implement RFID-based inventory systems aligned with IFRS and GAAP requirements.

- Standardize asset documentation for multinational operations.

- Prepare companies for external audits with accurate, audit-ready data.

Conclusion: Building Trust Through Robust Audit Evidence

Verifying the existence of fixed assets is far more than an accounting checklist — it’s a safeguard for financial integrity, operational efficiency, and stakeholder trust. Strong audit evidence ensures that every building, machine, or IT asset listed on the balance sheet truly exists, is in use, and is supported by solid documentation.

From physical inspections and RFID tracking to independent valuations and compliance with IFRS and GAAP, each step adds another layer of certainty. When done consistently, this process not only meets audit requirements but also strengthens governance, reduces risk, and protects company value.

At CPCON, we combine more than 25 years of global expertise with advanced technologies to deliver total control and transparency in asset verification. Our clients gain the confidence of knowing their records reflect reality — a crucial advantage in today’s fast-moving business environment.

Your assets are your foundation. Make sure they’re verified, compliant, and ready for the future.

Talk to our experts and discover how CPCON can help your company.

FAQ

How often should companies collect audit evidence for fixed assets?

Ideally, audit evidence should be collected continuously through automated tracking systems and reviewed formally at least once a year during the annual audit. High-value or high-risk assets may require quarterly checks.

What is the most reliable type of audit evidence for asset verification?

Physical inspection remains the most reliable method, especially when combined with asset tags, RFID scans, and photographic proof. Documentary evidence, such as invoices and title deeds, reinforces the verification.

Can technology replace manual asset verification?

Technology like RFID, barcode scanning, and GIS mapping greatly improves accuracy and efficiency, but it should complement, not replace, physical inspections and documentation reviews.

How does audit evidence help with regulatory compliance?

Audit evidence supports compliance with IFRS, GAAP, and local regulations by proving the existence, ownership, and valuation of assets. Well-documented evidence speeds up external audits and reduces the risk of penalties.

What should a company do if audit evidence reveals missing assets?

Investigate immediately, reconcile the asset register, adjust financial statements if necessary, and strengthen internal controls to prevent recurrence. In cases of suspected fraud, involve internal audit and, if required, legal authorities.

Get to Know CPCON Group: A global expert in asset management and inventory solutions

CPCON Group is a global leader in asset management, fixed asset control, and RFID technology. With over 25 years of experience, we have supported major companies such as Nestlé, Pfizer, Scania, BASF, Coca-Cola Andina, Vale, Vivo, Petrobras, and Caixa in high-complexity projects.

Curious about our global footprint? We are present in:

- North America: Toronto, New York, Miami, Minneapolis, Seattle, Dallas

- Latin America: São Paulo, Buenos Aires, Lima, Bogotá, Mexico City

- Europe: Lisbon, Porto, London, Birmingham, Milan, Rome, Turin, Madrid, Bilbao

- Middle East: Dubai, Saudi Arabi

- Caribbean: Tortola, Grand Cayman

Follow our LinkedIn Showcase Page and stay updated with strategic content on asset control, inventory management, and RFID innovation across industries.

This article explains how to collect and analyze audit evidence to verify the existence of fixed assets, highlighting its role in ensuring financial integrity and compliance with IFRS, GAAP, and local standards. It covers methods such as physical inspections, document reviews, RFID, barcode scanning, GIS mapping, depreciation analysis, and independent valuation reports. The content also addresses common verification challenges, best practices for internal controls, and the integration of digital asset management systems for faster, more accurate audits. With 29 years of global experience, CPCON delivers advanced technology and asset management solutions to ensure total control, transparency, and confidence in every verification process.