Picture a rapidly growing company acquiring new equipment, expanding facilities, and upgrading infrastructure. Yet amidst this progress, a silent problem emerges: fixed asset management. Outdated spreadsheets, duplicate records, and lack of depreciation control are just a few obstacles that undermine financial and operational accuracy. If this sounds familiar, you’re not alone. Many organizations struggle with fixed asset accounting, whether due to poorly defined processes or inadequate tools. The result? Decisions based on unreliable data, tax risks, and avoidable losses.

In this article, we’ll explore practical strategies to enhance the quality and compliance of your asset tracking, ensuring more reliable reporting and efficient management. Plus, we’ll show how CPCON, a leader in fixed asset solutions, can help turn this challenge into a competitive edge.

Table of Contents

ToggleWhy is fixed asset accounting important?

Fixed assets represent a significant investment for any business. Equipment, buildings, vehicles, and technology play a crucial role in daily operations and require structured management.

Without proper monitoring, companies face:

- Over or under-valuation of assets, affecting financial statements and tax calculations.

- Poor traceability, making maintenance and audits difficult.

- Non-compliance risks, leading to fines and operational inefficiencies.

Improving fixed asset accounting isn’t just about organization; it’s a strategic move to ensure transparency and long-term financial stability.

5 steps to improve asset control accuracy

Enhancing fixed asset accounting requires a structured approach. Without clear processes, companies risk data inconsistencies, financial misstatements, and compliance issues.

By implementing the right strategies, businesses can ensure accurate records, optimize asset utilization, and improve decision-making. Below are five essential steps to strengthen asset control and financial accuracy.

Standardize asset registration

The first step is to establish a structured process for recording assets. Many companies still rely on outdated spreadsheets, increasing the risk of errors. Instead, use a centralized system that:

- Classifies assets correctly (category, useful life, valuation).

- Updates information in real time.

- Integrates with departments such as finance, procurement, and operations.

Automate depreciation calculations

Manually calculating depreciation is time-consuming and prone to mistakes. Using specialized software ensures compliance with accounting standards while reducing human error and saving time.

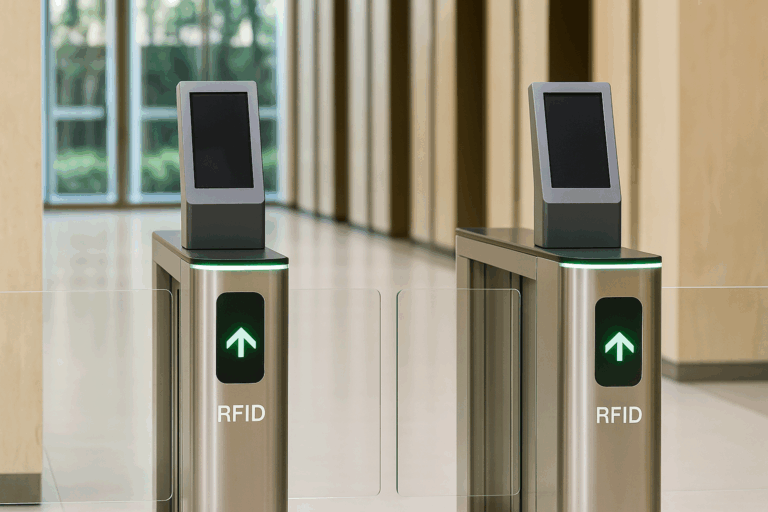

Conduct regular inventories with RFID technology

One of the biggest challenges in fixed asset accounting is ensuring that records match physical assets. RFID (Radio Frequency Identification) is a game-changer in this regard.

CPCON offers RFID solutions that allow:

- Mass identification of assets in seconds, without manual scanning.

- Real-time tracking to prevent asset loss.

- Seamless integration with asset management systems, ensuring data accuracy.

Companies that implement RFID reduce manual inventory time by up to 90% while significantly improving data accuracy.

Enhance cross-department collaboration

Fixed asset management isn’t solely a finance responsibility. IT, operations, and facilities teams must also be involved in acquisitions, transfers, and disposals to ensure accurate records.

Use specialized asset management software

A dedicated fixed asset management system helps eliminate manual errors and provides real-time insights. With a robust platform, companies can:

- Monitor asset location and condition.

- Schedule maintenance and renewal alerts.

- Generate reports for audits and compliance.

CPCON: Advanced technology and expertise in asset management

CPCON is a global leader in asset and inventory management, offering customized solutions to improve operational control and security. Our services include:

- High-tech asset inventory solutions.

- RFID-based tracking systems for automated asset control.

- Cloud-based software for seamless asset management.

- Auditing and financial reconciliation services.

- Process standardization and digital transformation.

With over 2,500 organizations served worldwide, CPCON ensures excellence in inventory control, asset tracking, and compliance.

Accurate fixed asset accounting leads to better business results

Fixed asset accounting isn’t just a financial requirement—it’s a strategic tool for optimizing resources, preventing losses, and ensuring full transparency.

Investing in advanced technology like RFID, regular audits, and structured inventories guarantees efficient asset control.

Is your company struggling with asset management? Our customized RFID, software, and consulting solutions are designed to enhance efficiency, security, and business performance. Let’s talk and find the right solution for you!

FAQ

What is fixed asset accounting, and why is it important?

Fixed asset accounting tracks long-term assets like equipment and real estate. It’s key for a company’s financial health. It helps follow accounting rules and keep track of asset values and when they need to be replaced.

How can I ensure accurate asset tracking in my organization?

Use barcoding or RFID systems for better asset tracking. These tools help record and monitor assets accurately. Regular audits also help ensure asset data is correct.

What features should I look for in an asset management software?

Look for automated tracking, real-time reports, mobile access, and easy-to-use interfaces. These features make managing assets more efficient and accurate.

What are the steps involved in conducting regular asset reconciliation?

Reconciliation involves checking asset values against physical assets, finding discrepancies, and fixing them. Use automated tools and set a schedule for this process.

Why is it important to establish consistent asset valuation methods?

Consistent valuation methods are crucial for accurate financial reports. Use different methods like historical cost and market value for different assets. This ensures a true picture of the company’s finances.

How can training improve fixed asset accounting in my company?

Training is essential for better asset accounting. It helps employees understand and follow asset management rules. Regular training keeps them up-to-date and confident.

What preparations are necessary before conducting an asset audit?

Prepare by organizing audit trails and asset documents. Use audit software to make the process smoother. Make sure staff knows what to expect and can provide needed information.

What are some common challenges in fixed asset accounting?

Challenges include outdated software, poor team communication, and lack of training. These issues lead to inefficiencies. Addressing these problems helps improve asset management.