In the business world, where every number matters and every decision shapes a company’s future, fixed asset reconciliation is a fundamental pillar of financial management. This process ensures that accounting records accurately reflect the assets a company truly owns, preventing discrepancies that could distort financial statements, undermine transparency, and lead to compliance issues.

Neglecting this practice can be costly. Undetected errors, inconsistencies in records, and asset losses can result in significant financial impacts, from operational setbacks to audit complications and regulatory penalties. Without proper control, businesses risk making strategic decisions based on inaccurate data, ultimately harming their competitiveness and credibility in the market.

In this article, we will explore what fixed asset reconciliation is, why it is essential for a company’s financial health, and how to implement this process effectively to ensure greater accuracy, security, and asset control.

Table of Contents

ToggleUnderstanding fixed asset reconciliation

Fixed asset reconciliation plays a vital role in financial management, ensuring that a company’s accounting records accurately reflect its real assets. This process is essential for maintaining precise financial reporting, regulatory compliance, and overall business transparency.

By reconciling fixed assets, businesses verify the existence of recorded assets and address discrepancies before they lead to financial misstatements or operational inefficiencies.

Definition and overview

Fixed asset reconciliation is the process of ensuring that a company’s recorded asset values align with its actual physical assets. This involves comparing balance sheet entries with real-world assets to confirm accuracy and reliability. By systematically reviewing these records, businesses can identify inconsistencies, correct errors, and maintain an accurate financial picture.

This practice is fundamental to a company’s financial health, providing a solid foundation for sound decision-making and compliance.

Importance in financial management

Accurate asset reconciliation is critical for maintaining integrity in financial records, reinforcing confidence in asset valuations, and supporting informed investment and operational decisions. It also plays a key role in audit preparedness, helping businesses avoid regulatory penalties and financial misstatements.

Regular reconciliation enhances transparency and allows companies to detect and resolve issues early, preventing costly errors and ensuring smooth financial operations.

| Reconciliation Aspect | Description |

|---|---|

| Verification | Ensures recorded assets match physical existence. |

| Adjustment | Identifies and corrects discrepancies in records. |

| Documentation | Maintains accurate and up-to-date asset records. |

| Compliance | Meets regulatory requirements for financial reporting. |

Why is fixed asset reconciliation important?

For any business aiming to maintain financial order, fixed asset reconciliation is essential. It ensures that financial reports accurately reflect the company’s actual assets, providing a solid foundation for decision-making and long-term success.

Impact on financial reporting

Accurate financial reporting depends on proper fixed asset reconciliation. By verifying asset values, businesses prevent discrepancies that could lead to misleading financial statements. Errors in reporting can misinform investors, mislead regulators, and ultimately damage the company’s credibility.

Inaccurate financial reports can result in regulatory penalties, lost investor confidence, and financial instability. That’s why ensuring asset values are correctly recorded is not just good practice – it’s a necessity.

Enhancing operational efficiency

Beyond financial accuracy, effective fixed asset reconciliation contributes to operational efficiency. It helps businesses track and optimize asset usage, avoid unnecessary purchases, and improve resource allocation.

With a clear view of their assets, companies can make smarter strategic decisions, streamline operations, and enhance overall performance.

Fixed asset reconciliation: why ignoring this process can be costly?

Fixed asset reconciliation is often overlooked, but neglecting this critical process can have significant consequences for businesses.

It affects not only the accuracy of financial statements but also the operational efficiency and compliance of the company. Ensuring proper reconciliation is a fundamental part of maintaining financial health and stability in any organization.

Financial risks of negligence

Neglecting fixed asset reconciliation can lead to serious financial repercussions. Without regular checks and proper management, asset values can become inflated or inaccurately reported, which distorts the accuracy of financial statements. This misrepresentation can mislead investors, regulators, and stakeholders, ultimately eroding trust and damaging the company’s reputation.

If assets are mismanaged, businesses may also face substantial tax liabilities due to inaccurate reporting. In the long run, such mistakes can cost much more than the time and effort required to perform regular reconciliations.

Compliance issues and regulatory consequences

In addition to financial risks, neglecting fixed asset reconciliation can lead to significant compliance challenges. Financial reporting standards require companies to accurately track and report their assets.

Failing to do so can result in hefty fines, legal consequences, and a tarnished reputation. Compliance with regulations, such as Sarbanes-Oxley (SOX) and International Financial Reporting Standards (IFRS), is not just about avoiding penalties – it’s also about building and maintaining a company’s credibility and trustworthiness in the market.

Potential for errors and discrepancies

One of the greatest risks of failing to reconcile fixed assets is the potential for errors and discrepancies. Without a reliable reconciliation process, businesses may find that their records don’t match the actual assets they own.

This can lead to misinformed decisions, incorrect financial reports, and ultimately put the business at risk. The absence of proper tracking can cause significant confusion and hinder long-term growth.

Best practices for effective fixed asset reconciliation

To prevent these challenges and ensure accurate financial management, businesses should implement a set of best practices for fixed asset reconciliation. These practices can help improve record accuracy, enhance compliance, and streamline operations:

Regular audits and evaluations

Conducting regular audits and asset evaluations is essential to keep financial records transparent and up to date. Periodic checks help identify discrepancies early, ensuring that issues are addressed before they escalate into bigger problems.

Utilizing technology for automation

Technology plays a crucial role in improving the accuracy and efficiency of asset reconciliation. Automated systems reduce human error, speed up processes, and provide real-time visibility into asset management. Leveraging software solutions for asset tracking ensures better documentation and easier audits.

Employee training and awareness

Educating employees on the importance of fixed asset reconciliation is essential for maintaining accuracy. Proper training ensures that staff members understand the nuances of asset management and are equipped to carry out thorough audits and reconciliations. This leads to more reliable records and better decision-making.

Common challenges in fixed asset reconciliation

Fixed asset reconciliation is not without its challenges. Many companies face obstacles that hinder their ability to manage assets efficiently:

Data accuracy and integrity issues

One of the most common challenges is ensuring the accuracy and integrity of asset data. Inconsistent tracking methods, outdated technology, and lack of standardized processes can all contribute to inaccurate records, leading to discrepancies and mismanagement.

Inadequate resources and time constraints

Many businesses struggle with limited resources or insufficient time to perform thorough reconciliations. This often results in rushed, incomplete audits that overlook critical details. Without the proper tools and personnel, asset reconciliation becomes a daunting and error-prone task.

Discovered how CPCON can help

Fixed asset reconciliation is a cornerstone of effective financial management and corporate governance. It is crucial for businesses to take the necessary steps to avoid the costly mistakes that come from neglecting this process. By adopting best practices such as regular audits, utilizing automation, and investing in employee training, companies can significantly reduce the risks associated with asset mismanagement.

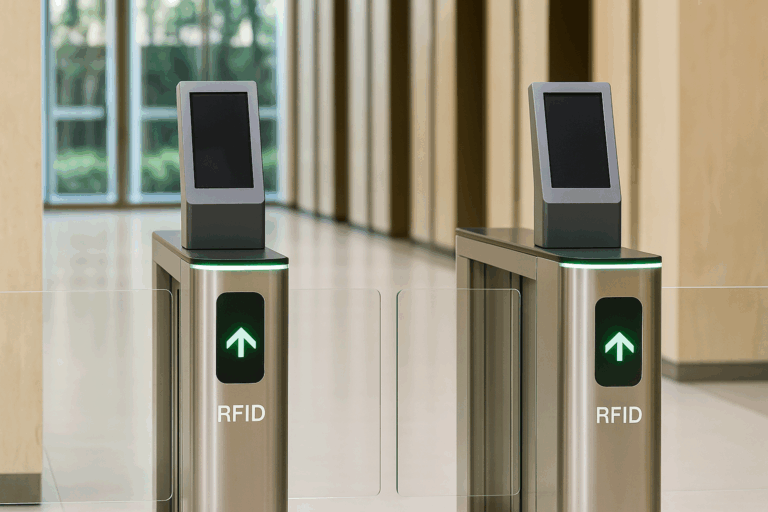

This is where CPCON can help. With over 29 years of experience in the field of fixed asset management, CPCON provides businesses with the tools, expertise, and solutions to streamline their asset reconciliation processes. From traditional barcode systems to cutting-edge Radio-frequency Identification (RFID) technology, CPCON offers a full suite of services that ensure accurate, real-time tracking and reporting of fixed assets. With a proven track record of helping more than 2,700 clients across diverse industries, CPCON can support your company in achieving better financial supervision, enhanced compliance, and more efficient asset management.

Whether your business is looking to improve internal controls, meet regulatory standards, or optimize asset usage, CPCON’s solutions are designed to meet your needs. By partnering with CPCON, you ensure that your company remains on track, with accurate financial reports and a well-managed asset portfolio.

FAQ

What is fixed asset reconciliation?

Fixed asset reconciliation checks if a company’s financial records match its actual assets. It involves looking at financial entries and checking assets in person. This makes sure their values are right.

Why is fixed asset reconciliation critical for businesses?

It’s key for keeping financial reports accurate. This is important for investors, stakeholders, and following the law. It stops big mistakes in asset values.

How does fixed asset reconciliation impact financial reporting?

It makes sure asset values are correct. This means financial statements are reliable. It also helps avoid legal trouble and attracts investors.

What could happen if a company ignores fixed asset reconciliation?

Ignoring it can cause asset values to be too high. This leads to wrong tax payments and profit margins. It can hurt the company’s trustworthiness.

What best practices should companies implement for effective fixed asset reconciliation?

Regular audits and checks are a must. Using technology and training staff can make it more accurate and efficient.

What are common challenges in fixed asset reconciliation?

Data accuracy is a big problem. Old systems and tracking issues cause mistakes. Also, not enough time or resources can slow it down.